Apartment buildings posted an increase in rents in the first quarter of 2010. As the economy continues to stabilize, the sector offers attractive investment opportunities. However, there is still a large supply of housing listed for sale, foreclosure rates remain high, and failed condominium developments still compete with market rate rentals in many places around the country.

Investors need to think carefully about the dynamics of this so-called “shadow inventory,” and whether it will be a significant factor that may hold back rental income growth for specific geographical areas like South Florida and Las Vegas.

The drag of large shadow inventories can be significant. There is widespread consensus that there will be a supply shortage of multifamily rentals as early as next year. This constrained supply may lead to robust rent growth, as echo boomers enter a more stable job market and push up demand for rental units.

However, a large shadow inventory may shave off as much as half of the rent growth that a metro area could experience, stunting income potential during a time when recovery should be well underway.

Do single-family homes count?

Whether an extended period of high vacancies for single-family homes will affect multifamily buildings is an important question. Our researchers at Reis have examined how variables like the vacancy of single-family homes for rent relate to foreclosure rates. As one might expect, there is a positive correlation.

However, investors should be skeptical of any chart that draws simple correlations between the vacancy rates of single-family homes and multifamily properties without accounting for whether supply additions to both property types increased at similar rates.

Furthermore, one must consider whether economic conditions in the overall area warrant higher vacancy rates for rental properties across the board.

Whenever we’ve tried to establish causal relationships between single-family vacancies and multifamily vacancies in a formal econometric setting, controlling for possible omitted variables, we’ve found any relationship to be weak at best and difficult to establish for most.

The two property types may not be perfect substitutes. If you lose your single-family home to foreclosure, you will most probably rent a single-family home. If you prefer to rent an apartment in a building with 20 units or more, you probably wouldn’t want to live in a single-family home at that point in your life, worrying about flooding basements and shoveling snow.

In other words, the inventory of distressed and foreclosed single-family homes may affect single-family home vacancy rates, but the effect on multifamily vacancy rates will be marginal, after controlling for other variables.

What about the “race to the bottom” story? The argument is that short sales or foreclosures will result in single-family homes purchased at rock-bottom prices, allowing buyers and investors to charge rents that are way below market and still make a decent profit. So rental property owners across the board will be pressured to lower rents to compete, leading to depressed rent growth.

However, there is a flaw in this reasoning. Why would buyers and investors of distressed homes cut offered rents so far below market when they could charge rents at, or near, the market rate and earn even more profit? The “race to the bottom” story is not a stable equilibrium and is therefore implausible.

What should go into the mix?

If we assume that single-family homes shouldn’t be part of shadow inventory, we must focus on condos, townhomes and other types of multifamily housing that aren’t part of the competitive stock of market rate rentals. At Reis, our new construction team tracks the pipeline of such projects all the way from planned and proposed stages to when the project is completed.

We then add this to the stock of “potential competition” that might serve as substitute housing options on a market-by-market basis. For example, student housing options are obviously going to impact university towns like New Haven, Conn., and Boston.

Note that we do not track the performance (vacancies, rent growth, resale patterns) of these different property types: only patterns of how they add to the stock of potential competition versus market-rate rentals. This gives us an idea of the relative size of the so-called shadow market.

If we had unlimited resources, we would track vacancies and rent changes across all potential substitutes for multifamily properties, but that would be an immense task.

No one has, to my knowledge, been able to truly quantify the size of the shadow market across geographical areas mainly because it’s nearly impossible to do on a unit-by-unit basis. We do, however, try to get a sense of the relative importance of the shadow market by tracking the pipeline of new construction.

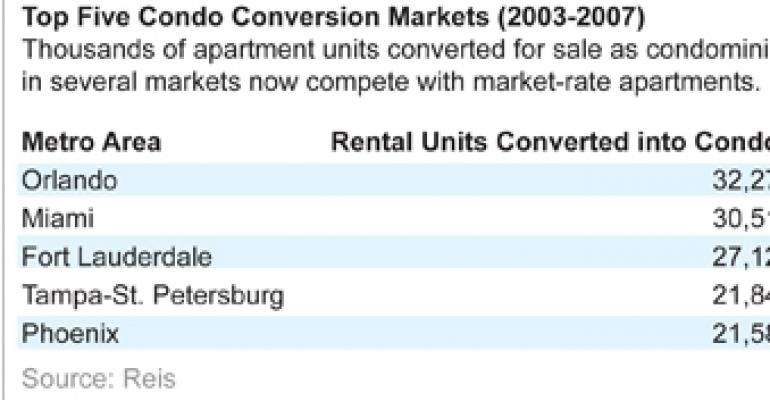

What we do track very carefully is the ebb and flow of conversion activity, since this directly impacts the stock of rental inventory. Reis can identify which rental complex was converted into condos for sale during the boom from 2003 through 2007, and we carefully track which buildings are now flowing back to the stock of market rate rentals either through reconversions or repurposing.

The top conversion markets are obviously prime candidates for higher shadow inventory activity. It is not surprising that four out of the top five are in South Florida, but some clients are surprised that metros like suburban Virginia make it to the top ten. So in formulating our near-term outlook we carefully consider past conversion activity as a strong proxy for the size of the shadow market.

There are many signs that augur for strong income growth from apartment properties over the next couple of years. Combine limited supply coming online through 2012 with a recovering economy supporting the influx of echo boomers into the rental market, and many foresee a robust upside to apartment investments in the near term. Nevertheless, it pays to consider the size of various shadow markets to assess potential downside risks for specific areas.

Victor Calanog is director of research for New York-based research firm Reis Inc. His monthly column delivers insights on performance trends in commercial real estate.