Clouds are lifting over Miami’s beleaguered condo market following a boom-and-bust cycle of epic proportions. According to a recent study commissioned by the City of Miami’s Downtown Development Authority (DDA) and conducted in partnership with Goodkin Consulting and Focus Real Estate Advisors LLC, condo sales and occupancy rates are on the rise.

“We’re coming out of the most prolific overbuilding in the history of Southeast Florida,” says Jonathan Kingsley, executive vice president and managing director at brokerage firm Grubb & Ellis.

The Residential Closings and Occupancy Study, published in March 2010, updated a similar report issued in June 2009. Both studies examined 75 completed condominium buildings located in a 60-block area in downtown Miami. Many of the buildings adorn prestigious Brickell Avenue and other units overlooking Biscayne Bay.

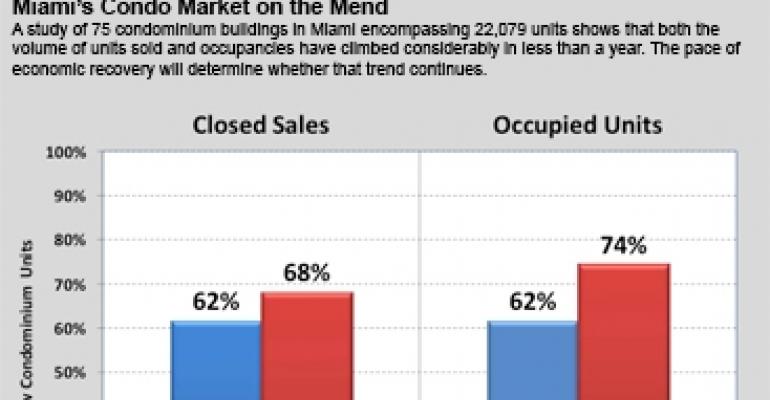

The study found that in February 2010, 74% of the 22,079 units built since 2003 were occupied versus 62% in May 2009. An average of 345 units were leased monthly last year.

Full-time residents occupy 87% of the 16,415 units. Of those units, a little more than half (52%) are rented. “There’s a younger crowd, new businesses and lots more after hours people,” notes Alyce Robertson, the DDA’s executive director.

Sales also increased. More than 15,000 of the existing units, or 68%, were sold at the end of 2009 compared with 62% in May 2009. Average monthly sales in the downtown Miami area totaled 350 units in the fourth quarter of last year, a whopping gain of more than 200% over the fourth quarter of 2008.

Approximately 7,000 condo units remain on the downtown market. If current trends continue, the study predicts that all of downtown Miami’s existing condo inventory could be occupied within 25 months.

Tempering the exuberance

“There’s been a movement to the downtown area based on affordability that didn’t exist previously,” explains Craig Werley, president of Focus Real Estate Advisors. However, he cautions the projections depend on employment stability and job creation. “We’re not out of the woods yet,” he says.

Other caveats: A significant number of buyers were investors “looking for an appreciation play,” Worley explains, “so potentially a large number of units could be fed back onto the market.” And rental rates across the board generally “don’t provide a positive cash flow to cover homeowner association fees and taxes.”

Jack McCabe, CEO of McCabe Research and Consulting based in Deerfield Beach, Fla., agrees. “When you peel back the skin it isn’t so pretty,” he says. “We’ve seen sales pick up — primarily cash deals to bulk investors and international buyers — at deeply discounted prices. It’s basically a cash buyers’ market.”

McCabe adds that prices have fallen some 50% to 70% to $200 to $250 per sq. ft. from a high of $500 to $600 per sq. ft. at the market’s peak.

Sales of existing condos in Miami increased 46% to 1,920 units sold compared with 1,311 in the first quarter of 2009, according to the Florida Association of Realtors. However, the median price fell 9% to $136,100 compared with $149,000 a year earlier.

Financing hurdles remain

Peter Zalewski, founder of Condo Vultures Realty LLC, a firm specializing in condo sales, research and consulting, reports only 17% of the 713 new condos sold during the first quarter in the greater downtown Miami area obtained financing.

The remaining sales were cash transactions. He estimates that only approximately one out of four transactions involve primary users; the remaining units are sold to speculators with cash. Like many other observers, Zalewski says the impact of the first-time homebuyer tax credit was minimal.

Recently Fannie Mae and Freddie Mac announced plans to ease existing stringent guidelines to provide more financing for Florida’s condo market. In January, Fannie Mae introduced the Special Approval Designation program and assigned a team of six professionals to review existing condo projects that previously failed to qualify for the agency’s financing because of foreclosures, high vacancy rates, unpaid homeowner association fees and other expenses.

If the team awards a building a Special Approval Designation, lenders can originate and deliver mortgages to the agency. “It’s setting the scene,” Zalewski says. “The dividend will be paid in 2011.”