Losses on commercial real estate loans held by the nation’s life insurance companies grew at a slower rate than expected in 2010, surprising many analysts. The better-than-expected performance was due to more conservative underwriting at the peak of the market and sound management of loan losses during the depths of the Great Recession, according to Fitch Ratings.

Insurers lost $1.45 billion on their commercial mortgage loans in 2010, compared with losses of $1.51 billion in 2009. That performance was substantially better than a leading forecast by Fitch, which had expected losses of up to $3 billion.

Fitch has tempered its concerns over the industry’s loss exposure to mortgage loans based on an analysis of recent losses and a developing recovery in the commercial real estate market. Certainly, the numbers paint a compelling picture. Approximately 99.6% of mortgage loans held by U.S. life insurance companies were in good standing as of Dec. 31, 2010, a level similar to year-end 2009.

The lower-than-expected losses are due to several factors, including life insurers’ solid underwriting, their flexibility to modify loans, as well as low interest rates, according to Fitch. Also, many insurers have restructured their at-risk loans, or sold them off at improved pricing levels.

In short, life insurers have mitigated their troubled mortgages with “active management,” namely selling underperforming mortgages to third-party investors or non-insurance affiliates, concludes Fitch.

Life insurers currently account for 22% of the $2.4 trillion of total outstanding commercial real estate debt, according to the Mortgage Bankers Association.

Michael Grant, director of capital markets at Chicago-based Cohen Financial, says life insurance companies slowly re-emerged as an important source of debt capital for commercial real estate beginning in the second quarter of 2010.

Commercial mortgage lending continues to play an important role in many life insurers’ investment portfolios. First-quarter 2011 loan originations for life companies increased 126% compared with the first quarter of 2009, when the recession had taken hold of the commercial real estate industry.

Storm clouds ahead?

It is anything but clear sailing for insurers in the months ahead, however. Many analysts fear that as competition to lend on a limited number of high-quality assets has intensified, underwriting standards have begun to slip back to the more relaxed days of the market peak in 2006-2007.

For example, loan-to-values have moved from less than 60% during the depths of the recession in 2009 to 70% and higher today, which is a return to pre-recession levels. “We are deeply concerned,” says Tad Philipp, director of commercial real estate research for Moody’s Investors Service in New York.

Recently, Fitch reported that the volume of troubled mortgages held by U.S. life insurers increased 15% to $1.1 billion in 2010. However, the agency views that exposure as “manageable.” Fitch defines troubled mortgages as delinquent mortgages, those in the process of foreclosure and restructured mortgages. Troubled mortgages as a percentage of mortgage portfolios increased moderately in 2010 for life companies, ending the year at 0.39% compared with 0.33% at the end of 2009.

Losses for life companies this year are expected to exceed the 2010 level of 0.5% of mortgages, or $1.4 billion, but not to exceed 1%, or $3 billion.

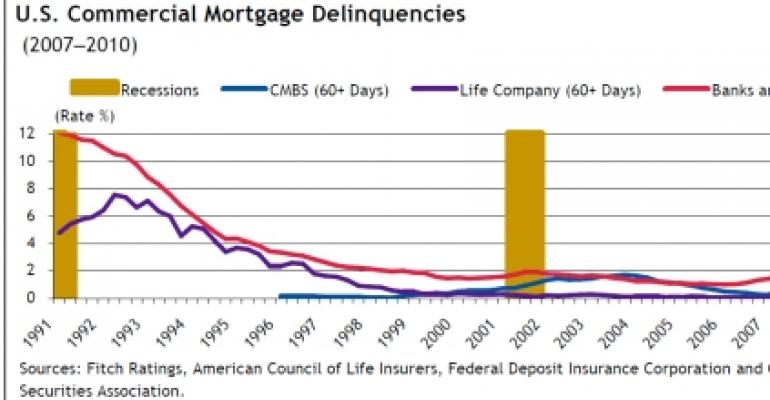

While delinquencies, foreclosures and restructurings are expected to remain at levels above the insurance industry average over the past 10 years, Fitch believes that the more conservative underwriting and flexibility found in life company loan portfolios in workout situations will continue to result in a favorable comparison to the commercial mortgage-backed securities market.

Ultimately, life insurance companies may find themselves on the sidelines as lenders in the near future. “The surge in life company lending has already occurred,” says Chris Macke, senior real estate strategist with CoStar Group. “Up until recently, they had a nice run with minimal competition. At this point they are likely near, or at, their lending capacity as a group, which is estimated to be around $35 billion.”

Assuming the lending markets continue to thaw, life insurance companies will face increasing competition, explains Macke. “This will put upward pressure on their loan-to-values going forward, and downward pressure on their pricing.”