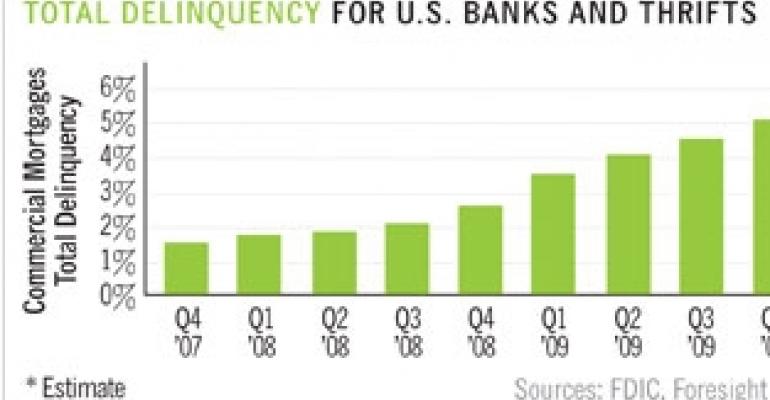

Although final figures for the first quarter won’t be available until late May, early estimates show that commercial mortgage delinquency rates rose to 5.5%, up from 5.1% in the fourth quarter, according to Oakland, Calif.-based Foresight Analytics, a unit of Trepp LLC. The analysis is based on earnings reports and call report filings from many small banks.

Over the last three quarters of 2009, Foresight’s commercial mortgage delinquency estimates have been within four-tenths of a percentage point from actual figures.

“The 5.5% delinquency rate is still well below the 8% delinquency rate in the third quarter of 1991, but it is worrisome in light of weak fundamentals, constrained credit availability and a high volume of commercial mortgages coming due during the next several years,” says Matt Anderson, managing director for Foresight.

Based on current data, the research firm forecasts that commercial mortgage delinquencies will peak in the first half of 2011, topping out at 7.5% to 8%. “If the economy recovers very strongly and quickly, the peak in commercial mortgage delinquency rates could come sooner and it might be a bit lower,” says Anderson.

Even if delinquency rates on commercial mortgages held by U.S. banks and thrifts do reach as high as 8% next year, commercial mortgage-backed securities (CMBS) default rates are forecast to outpace them by a wide margin. New York-based Fitch Ratings now forecasts CMBS defaults to exceed 11% by the end of 2010.

CMBS is being hit harder as a result of larger loans originated during the peak years. In 2009, 56 loans over $50 million in size defaulted compared to just five in 2008, Fitch reports. Not surprisingly, most of the defaulted loans came from 2006 to 2008 vintages.

In stark contrast, delinquency rates on single-family and commercial real estate construction loans held by banks and thrifts may well be at or near bottom already. Total estimated delinquencies in construction loans rose to 19% in the first quarter, up from 18.6% in the fourth quarter, according to Foresight, which reports that the rate is close to the 19.2% peak in the first quarter of 1992.

While for-sale residential construction loans (single family and condo) are by far the main source of problems, Foresight’s estimates indicate that construction delinquency rates for apartments and commercial properties are currently in the 10% to 12% range. “Overall we think the construction delinquency rate will probably peak in the next couple of quarters,” Anderson predicts, noting also that there will still be some weakness ahead tied to what happens to fundamentals.

Foresight also released early estimates for first-quarter business loans, known as commercial and industrial loans (C&I), which are typically unsecured and separate from commercial mortgage lending. While these loans are estimated to have risen to 4.5% in the first quarter, up slightly from 4.4% at the end of the fourth quarter, lending volume is a better indicator for commercial real estate, says Anderson.

Business loans outstanding declined by 18% during 2009, compared with a 4% increase during 2008. Businesses feel the credit crunch with the volume of new C&I loans falling, says Anderson. “But the positive is that while it’s too early to say, in the last few weeks it looks as though that figure may be bottoming out and may be starting to come back. That in our view would feed into a stronger recovery for the economy overall.”