Many investors have criticized the reluctance of lenders to foreclose on defaulted loans, calling it one of the major reasons the real estate decline has proven to be as prolonged and unpredictable as it has.

But what a difference a year makes in the world of commercial real estate. Even though property prices slipped in December and January, the longer-term picture shows a rise in prices of 4.2% since touching an eight-year low in August 2010.

The figures recently released by Moody’s and Real Estate Analytics forcefully make the case for why foreclosure and distressed note sale activity has picked up markedly over the past nine months or so.

Repositioning rules

A bumper crop of unknown real estate buyers and sellers is now popping up at industry conferences and on social networking sites as professionals specializing in “off-market” transactions.

To be sure, these are mostly intermediaries hoping to cash in on the repositioning craze that has gripped the marketplace and now commands the attention of anxious special servicers — especially in the commercial mortgage-backed securities (CMBS) arena.

Off-market properties and distressed notes are today touted as those that have not been officially listed as “for sale,” but are available to the buyer who can readily produce a commitment letter of intent and proof of funds.

Many buyers see a chance to pick up properties for pennies on the dollar and turn them around at a fat profit. These investors are busy distributing legal documents around the industry.

But consider that according to the report from Moody’s, of the estimated 7,000 CMBS loans that were in special servicing as of Dec. 31, 2010, only 354 were officially reported as having been restructured or modified.

That is a far cry from a year earlier when lenders were extending more than 80% of troubled loans through various forbearance and modification programs. Lenders are foreclosing on about 71% of these loans today and modifying only about 29%.

Additionally, another watchword floating around the industry is recapitalization — a term that encompasses everything from an infusion of capital from an operating partner, to the restructure of existing debt and handing over part ownership to the note holder.

Repositioning is what most investors understand this process to mean, and there is now a mad dash to convince the industry that modification of loans can be easily lumped into the category of repositioning and recapitalization to maximize long-term returns.

Uncle Sam as seller

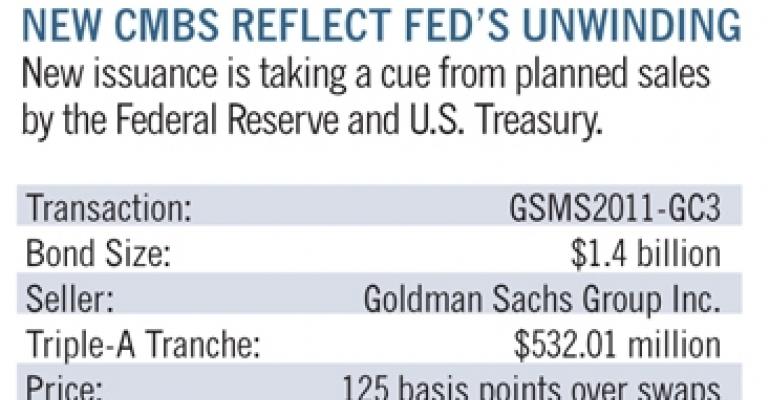

The U.S. Treasury Department announced it will begin selling about $10 billion of mortgage-backed securities per month over the next year.

As the Treasury Department and Federal Reserve wind down emergency lending and investment programs, all eyes are on the pricing and demand for these assets. The programs have largely been credited with saving the day after the onset of the financial crisis.

The Treasury Department has a $142 billion portfolio of mortgage-backed securities it bought in 2008 and 2009 to pump liquidity into the marketplace.

While most of the holdings are 30-year, fixed-rate mortgage-backed securities guaranteed by Fannie Mae and Freddie Mac, bond traders are already talking about signs pointing to healthy demand for these holdings. Some are even creating benchmark prices at which the bonds will be traded.

Insiders at the Treasury Department estimate that the U.S. government stands to reap a profit of $15 billion to $20 billion from such sales. New CMBS bonds from major players are being priced and structured to yield about what traders expect the Treasury Department’s mortgage-backed portfolios to fetch.

Finally, as a perfect commentary on this emerging end to extend and pretend, insurance giant American International Group (AIG) is now gearing up for a bidding war with Barclays Capital and other potential buyers over the very securities AIG was forced to hand over in exchange for a badly needed infusion of liquidity at the height of the financial crisis.

The Federal Reserve will be selling the securities as a part of its plan to shrink its balance sheet and further stabilize the market.

AIG formerly offered $15.7 billion to buy the bonds back from the Fed. According to a number of media reports, shortly after the AIG offer reached the front desk at the Fed, at least two other offers — one from Barclays and another from Credit Suisse Group AG — were already in the early discussion stage.

So the Fed might jump into the mortgage-backed securities auctioning arena as a top seller over the next year, and be among the first to score big as the off-market property and note sale train pulls out of the station.

Joseph Caton is a South Florida journalist who provides training and development services to real estate finance professionals.