With the approach of the holidays, institutional investors are hoping for a few gifts of their own from their private equity investment partners. At the top of their wish list: lower fees.

Thanks to billions of dollars in losses on their real estate investments over the past year, many pension funds and other institutional investors are ratcheting up the pressure on their partners to reduce, and in many cases, restructure the fees paid for their services.

In the go-go days of the mid-2000s that preceded today’s credit crunch, capital was free flowing and returns were high. Investors happily poured billions of dollars into private equity real estate funds. Now those days are long gone, and the pendulum of negotiating strength has swung decidedly from general partners to limited partner investors.

“Managers are indeed cutting fees, some voluntarily, some under duress,” explains Ted Leary, president of consultant Crosswater Realty Advisors in Los Angeles.

Until recently, fund managers structured their funds with so-called “2/20” fees, charging investors a 2% fee on their contributions during the fundraising period, and then another fee of up to 20% based on a percentage of the fund’s total profits once it closed.

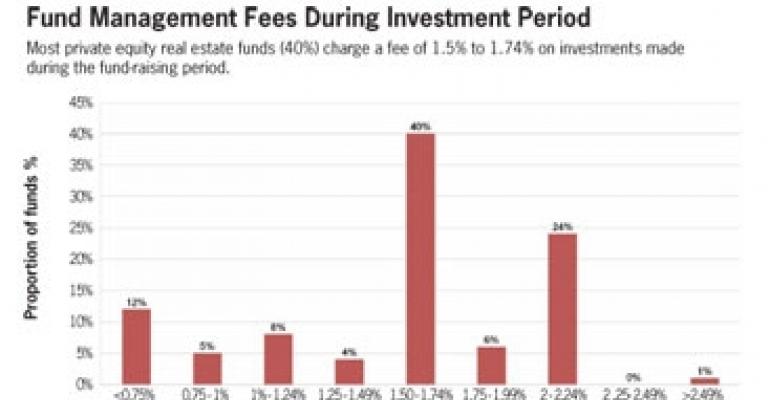

According to London-based private equity researcher Preqin, today’s fees vary widely and have come down from the old 2/20 standard. For example, most real estate funds now charge from 1.5% to 1.74% during their fundraising program (see chart).

More recently, managers have come under increasing pressure to trim their fees even further and to better align their fee structures to the actual performance of the funds.

That performance, of course, has been anything but sterling in recent months. According to the latest data from the NCREIF-Townsend Fund Index, private equity fund managers saw year-over-year total returns fall 13.44% in the first quarter and 9.2% in the second quarter.

Fundraising activity also has come to a near standstill. According to Preqin, private equity fundraising hit a new six-year low of $4.9 billion in the third quarter, down 88% from the $41 billion raised in the third quarter of last year.

Heeding the call

Many fund managers seem willing to accommodate their investor clients. In October, Fort Worth-based private equity player TPG (formerly Texas Pacific Group) returned $20 million to investors in its largest fund worth some $18 billion. That same month, Dallas-based Lone Star Funds cut its fees as much as 50% to help attract investors to two new opportunity funds totaling $20 billion.

One investor onboard with Lone Star’s strategy is the Oregon Investment Council, which invests monies on behalf of the state of Oregon and oversees $65 billion in total assets under management. Recently the council agreed to put $400 million into two of Lone Star’s new funds, based on the reduced fees.

Katy Durant, who chairs the Oregon Investment Council and is CEO of Portland-based Atlas Investments LLC, said the issue boils down to accountability. “We want the managers well compensated with salaries, office, travel and pursuit costs covered out of the management fees, but we want their windfall to happen on the carry [long term], not on the initial fundraising.”

Backing best practices

Durant has also led a push to adopt a new set of guiding principles created by the Toronto-based Institutional Limited Partners Association (ILPA). The group is the largest trade association for private equity investors.

Members include more than 200 international pension funds, endowments, foundations and insurance companies. In all, members of ILPA manage more than $1 trillion in private equity capital.

More than 70 respected institutional investors have lent their names to the principles, which are contained in a best practices document.

Though more of a tool than a binding agreement, the document is designed to establish a set of guidelines focused on enhancing partnership governance, strengthening alignment of interests and improving investor reporting and transparency for the private equity industry.

Among the big names endorsing the principles are the California Public Employees’ Retirement System (CalPERS), the California State Teachers’ Retirement System (CalSTRS), MetLife, the Teacher Retirement System of Texas and the Oregon Investment Council.

A similar set of guiding principles was first broached in 1996, but adoption never took hold since fundraising was easier back then. Now, thanks to the tough economic environment and a more vocal investor community, many industry experts believe the guidelines will finally take hold.

Under the “alignment of interest” section of the principles, the focus is on fees and, more specifically, restrictions on management fees and transaction fees.

For example, it posits the notion that management fees should be based on reasonable operating expenses and reasonable salaries so as not to be excessive. And the limited partners in the fund should have the power to review the fees annually.

Durant of the Oregon Investment Council notes that many funds are increasingly receptive to lower and renegotiated fees. “Many of our best managers understand and are willing to reduce their management fees and earn their larger fees on the carry.”

According to the agenda for a Dec. 2 meeting, the Oregon Investment Council and its advisory firm, PCA Real Estate Advisors, are now negotiating with Fortress Investment Group to lower fees on the council’s $300 million opportunistic real estate investment with Fortress.

The move reflects the dawn of a new day in the private equity world, concludes Durant. “There is growing support from other pension funds to encourage and demand closer alignment of interests in relationship to fees by the general partners.”