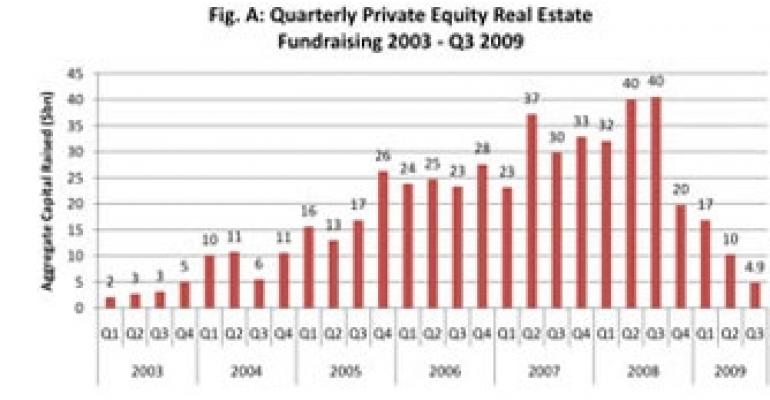

A total of 17 private equity real estate funds worldwide raised $4.9 billion in third quarter 2009, the lowest fundraising total for a quarter since the third quarter of 2003, when 17 funds raised $3.2 billion, reports London-based research firm Preqin. The figures for the third quarter also represent a significant fall from earlier in the year. The third quarter 2009 equates to 48% of the total raised in second quarter of 2009.

The decline from the same quarter in 2008, however, is even more dramatic— 2009 fundraising represents just 12% of the $40.5 billion, which was raised in the third quarter of 2008.

“Although it is clearly an extremely difficult period for the asset class, Preqin’s conversations with institutions indicate that these investors are not abandoning the private equity real estate asset class and will recommence investments in the fourth quarter of 2009 or during 2010,” said Andrew Moylan, manager – real estate data for Preqin. “It seems probable that fundraising will improve next year, but also seems likely that many more managers will be forced to abandon or delay their marketing efforts before the market improves.”

The number and aggregate target of private equity real estate funds in market has been declining throughout 2009. The aggregate target of all funds in market has fallen by $21 billion over the course of the third quarter, as fund managers have reduced their fundraising targets in response to investor activity, or in some cases abandoned their fundraising efforts altogether. Researcher Preqin has identified 46 private equity real estate funds, which have already been abandoned or put on hold in 2009 to date, compared with 27 in 2008.

In 2009 to date, just 18% of fund managers have achieved or exceeded their fundraising target, with 82% of funds falling short of their equity goals. This provides further evidence of how difficult the fundraising environment is at present, according to Preqin. In 2007, 79% of funds matched or exceeded their target size.