The good news is that the delinquency rate on loans underlying commercial mortgage-backed securities (CMBS) dropped 23 basis points in June to 9.37%, the second consecutive monthly decline, according to real estate analytics firm Trepp LLC.

The bad news is that the drop in the percentage of loans 30 days or more past due was driven primarily by a sharp spike in loans being resolved with losses, rather than delinquent loans actually curing.

Approximately $1.8 billion worth of loans were liquidated in June — the highest total since Trepp began measuring the loss resolution numbers 18 months ago. In total, 197 loans were liquidated in June. That compares to 148 loans with a face amount of $1.38 billion in May.

The losses on the June liquidations were about $837 million — representing an average loss severity of 46.4%. In May, the average loss severity was just under 43.2%.

Special servicers have been liquidating loans at a rate of about $996 million per month over the past 18 months. That means the $1.8 billion in liquidations in June was close to double the ongoing average, reports Trepp.

The elimination of these troubled CMBS loans from the pool reduced the delinquency rate by about 28 basis points. The remaining loans in the pool actually saw delinquencies rise about five basis points, leading to a net reduction of 23 basis points overall, according to Trepp.

Meanwhile, the percentage of loans seriously delinquent (60 or more days past due, in foreclosure, REO or non-performing balloons) stood at 8.75% in June, down 21 basis points from May.

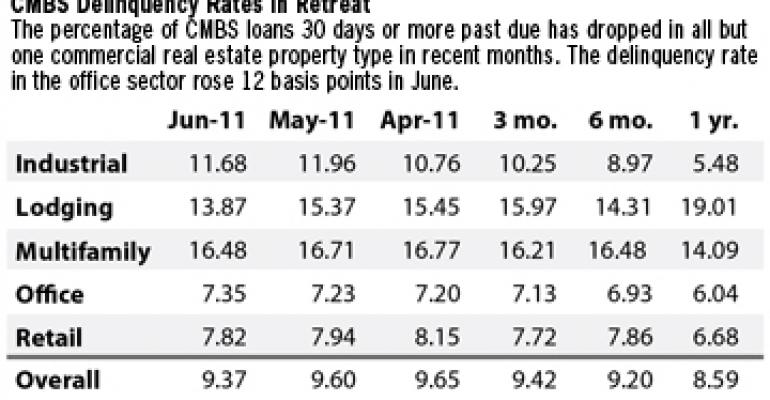

Even though the office sector was the only major property type in June to record a rise in the CMBS delinquency rate — up 12 basis points to 7.35% — the sector remains the best performer (see chart). The worst performing property type continues to be the multifamily sector with a double-digit delinquency rate of 16.48%.