The volatility on the international scene, much like the recent sudden decline in oil prices, is a stark reminder of the risks present when asset values are unusually dependent on monetary policy. Prolonged easy credit, such as investors have experienced during this recovery, has increased the vulnerability of markets to financial instability events as even small shifts in investor sentiment and the accumulation of aggressive loans can greatly magnify moves in global markets.

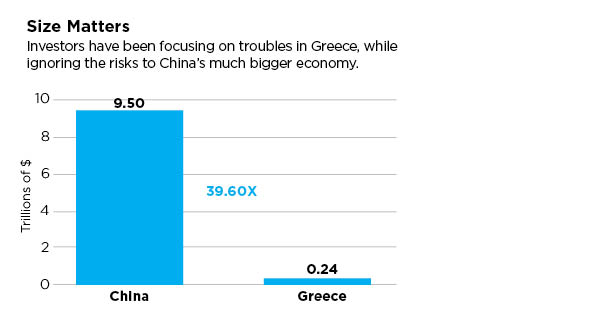

Now, while everyone was focused on Greece, the freefall in the Chinese stock market initially went relatively unnoticed—odd considering that the Chinese economy is nearly 40 times the size of the Greek economy. While the concern is that Greece may be only the first in a series of dominos, the Chinese stock market is actually melting down unabated.

Macroeconomic Issues

What should commercial real estate investors take away from the significant decline in Chinese stock prices?

International events today are a stark reminder that while U.S. commercial real estate has been relatively stable, not all asset classes are. Volatility outside of real estate, assuming it doesn’t lead to investors flooding into cash en masse, is likely to be a positive for the asset class as it increases the demand for real estate’s relatively stable income and the appreciation potential of well-located institutional real estate in a growing economy.

Continued volatility increases demand for safe-harbor assets like U.S. Treasuries and is likely to somewhat constrain Fed action, keeping interest rates relatively low and driving increased capital flows to real estate’s relatively high current income yields.

Some have asserted that the decline in Chinese stock prices could reduce demand from China for U.S. goods and therefore impact U.S. economic growth, citing the decline in Chinese imports from the U.S. in the last few years. However, declines in imports were occurring before the recent equity declines and were more likely a function of the broader slowdown in the Chinese economy. Additionally, Chinese equity markets are a surprisingly small portion of household financial assets, according to HSBC Chief Economist for Great China Qu Hongbin--barely 15 percent. Assuming equity declines are stemmed sooner rather than later they are not likely to have a significant impact on Chinese consumption (or imports).

Implications for Real Estate

For U.S. investors, especially those in the U.S. real estate market, the best advice is to stay the course and don’t let the nightly news unnecessarily increase the anxiety level. Although the temptation is there to stretch for that slightly higher yield by taking on more risk (going into smaller markets, engaging in style drift, taking on significant leasing risk etc.), even when the real economy looks like it isn’t running up capacity constraints, the impact of increasing global financial instability on the herd mentality (if not on actual asset values) can result in knee jerk reactions with less than optimal outcomes. In such an environment, the rewards for risk reduction and stable returns are likely to be more satisfying that incurring higher risks by chasing short-term higher returns.