Recent volatility in oil prices is an abrupt reminder to real estate investors of how quickly markets outside of commercial real estate can change. It is clear there are risks to being complacent, even in an asset class with longer-term return characteristics, when conditions can change quickly.

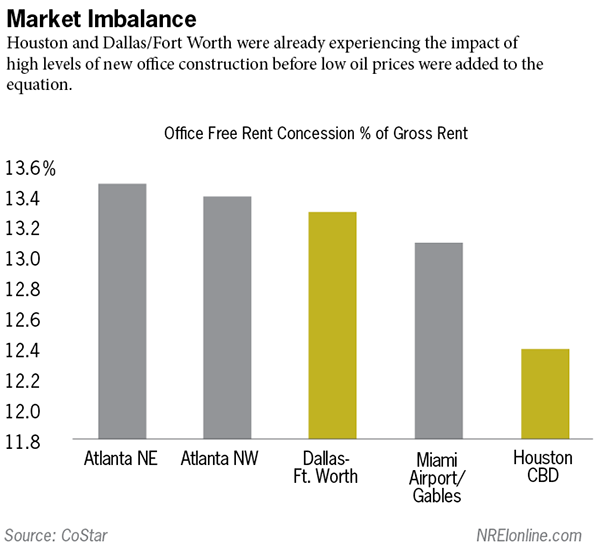

Steep declines in oil prices have led investors to focus on the implications for Texas commercial real estate. Over the last five years, Texas accounted for 67 percent of the increase in U.S. oil production and it is estimated that energy tenants occupy 51 percent of the Houston CBD office market and 28 percent of the Fort Worth market. Multiplier effects make the indirect impact of oil on Texas even greater. Additionally, significant additions to office supply and continuing office construction were already leading Houston CBD landlords to provide free rent concessions equal to 12.4 percent off of gross rent, while the Dallas/Fort Worth region offers 13.3 percent. Texas is the logical initial focal point for fallout from rapidly declining oil prices.

Lessons learned, however, are much bigger than Texas, especially in today’s environment of heightened risk complacency. The best way to understand economic events outside of one’s primary industry of expertise is to put them into a familiar framework. The dynamics underlying the recent and precipitous decline in oil prices read like a page out of the commercial real estate industry history books, complete with increasing supply, declining demand, and animal spirits. What is different, and instructive, for commercial real estate investors is the speed with which oil prices declined. While it can take years to add new office buildings to the supply of office stock, oil supply can be increased or decreased with the turning of a spigot. The difference is critical—while commercial real estate supply moves slowly, supply and prices of oil can shift suddenly and dramatically. This can create a mismatch between commercial real estate investor risk expectations and reality and lead investors to overweight return objectives at the expense of prudent risk management.

A familiar story

According to the U.S. Energy Information Administration (EIA), between November 2010 and November 2014 U.S. oil production increased nearly 4.6 million barrels per day—a 46 percent increase. During this same period, global oil production increased only 3.9 million barrels per day, meaning the U.S. provided 118 percent of the increase in global oil production between 2010 and 2014. During this same timeframe, U.S. oil consumption only increased 400,000 barrels per day, less than one-tenth of the increase in supply. Who absorbed the remainder? Not Europe, where demand declined more than one million barrels per day. China and its Asian neighbors increased consumption significantly, solidifying their role as key determinants of where oil prices eventually stabilize.

The current oil price decline story began elsewhere this summer. Hardly imaginable today, on June 26 Bloomberg Businessweek headlines read, “Rising Oil Prices Loom over World Economic Recovery.” Violence in Ukraine and Middle East uncertainty were primary factors cited as driving up prices.Fast forward to October, though, and we saw Iraqi oil supplies actually increase, while Libyan production grew more than 700,000 barrels/day. The real estate corollary might be if one expected a shortage of multifamily supply and, instead, supply suddenly increased, putting downward pressure on rental rates. Then, in October, the IMF published its concerns of weakening global growth, adding demand issues to supply concerns and driving prices lower. That would be like finding out the multifamily supply increase would be accompanied by decreasing net absorption.

Now, adding fuel to the fire, while investors expected OPEC to stabilize markets, as usual, the cartel announced after its November meeting that it would not cut supply to support prices and the Saudi oil minister stated there would be no intervention in oil markets even if prices dropped to $20 a barrel—at which point animal spirits and hedge funds betting on continued oil price increases wrested control from supply/demand fundamentals.

Increasing supply, declining demand, and animal spirits—sound familiar? These dynamics are similar to those that previously impacted real estate in 2008, when markets expected manageable supply, continued strong demand and healthy investor demand to support prices. But why did it happen so much more quickly and severely in the oil sector? First, one group, OPEC controls 40 percent of the oil market supply, unlike in the more broadly diversified real estate market. Second, OPEC members are not restricted by antitrust laws, allowing them to coordinate action, specifically on supply levels. Third, whereas it can take years to produce new real estate, the supply of and demand for oil can increase and decrease far more quickly. Fourth, and pardon my pun, oil trading markets are far more liquid than direct commercial real estate markets. Collectively, these factors make oil markets far more volatile.

Texas-sized lessons learned

Now that we understand why it happened, what can the real estate industry learn from the sudden and significant declines in oil prices? First, the decline should be a reminder of the importance of diversification. While commercial real estate moves at a relative snail’s pace, many other sectors do not. As a result, it is easy to become complacent at our own peril due to a myopic focus on the relative stability of our asset class. If you still have your doubts, consider the Tech Wreck of 2000 and its impact on tech-heavy markets or the disproportionate impact of the subprime mortgage crisis on housing-dependent markets. Recent events in the oil sector can be an invaluable reminder that sector volatility and asset pricing outside of commercial real estate can shift suddenly and dramatically, making today’s golden goose tomorrow’s ugly duckling with very real and negative implications for commercial real estate. It is still wise not to put all your eggs in one basket.

Second, because of the sudden nature with which dramatic shifts can occur in sectors and financial markets outside commercial real estate, economic shocks can occur much more suddenly than many in the commercial real estate industry may realize. The Swiss Franc is just one example of this. While we currently anticipate no dramatic shift in economic fortunes, it is prudent to maintain a longer-term balance between risk and return. Concentrating acquisitions in certain “hot” markets or chasing marginally higher cap rates into slower growth markets with inferior growth prospects will leave investors exposed when the tide inevitably recedes.

Third, while falling oil prices are playing a role in suppressing inflation this could quickly be reversed. For example, Libya and Iraq currently supply more than 4 million barrels of oil per day. Libya is in the middle of a civil war, while Iraqi oil supplies are always at the mercy of sectarian violence. A disruption in Middle East oil supplies, combined with a robust upturn in global economic growth, could quickly transform oil’s role as an inflation suppressor into an inflation accelerator.

Fourth, according to Bloomberg, U.S. exploration and production companies now comprise an ominous 17 percent of U.S. high-yield or junk bonds. At some point, if oil prices decline far enough for long enough, the high-yield bond market could experience significant illiquidity and raise concerns of greater financial contagion. Just six months ago, few could have imagined rapidly declining oil prices and a potential upheaval in the high-yield bond market. Just because we cannot see the financial cracks forming doesn’t mean they aren’t there. As a result, maintaining a balance between pursuing higher returns and risk control is critical in this environment.

Where to from here?

Yes, Texas may be the initial center for oil price related fallout. However, astute investors will realize that the most profitable lessons learned will be found outside of Texas. Any market’s stability can change in an instant and volatility can arise quickly and unexpectedly, given domestic/geopolitical uncertainty and the familiar investor animal spirits. This affirms the importance of focusing on long-term returns and risk management. At American Realty Advisors, we do this in many ways, including targeting high-quality assets in markets with favorable long-term growth prospects as opposed to trying to time short-term yield gains.

Christopher Macke is managing director, research and strategy, for American Realty Advisors.

Christopher Macke is managing director, research and strategy, for American Realty Advisors.