A slight hiccup in second quarter investment sales has some in the industry wondering whether this was a minor blip on the radar or a signal of a broader shift in the market.

There is no question that there remains plenty of capital and strong buyer demand for U.S. commercial real estate. “Generally, the overall level of transactions remains very robust and the market very liquid,” says Peter Muoio, chief economist at Auction.com, an online marketplace for buying and selling real estate.

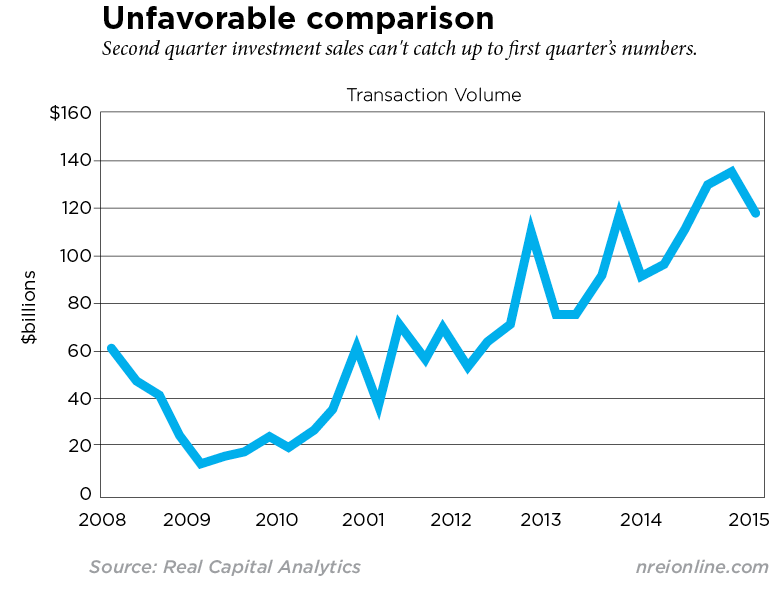

Overall, the $255.1 billion in commercial real estate investment sales during the first half of the year is up a healthy 36 percent compared to the first half of 2014, according to data from Real Capital Analytics (RCA), a New York City-based research firm. That figure includes sales above $5 million across the four major commercial asset classes, as well as hotels. Yet quarter-over-quarter data paints a different picture, with second quarter sales of about $118 billion, down 14 percent or about $20 billion compared to the first quarter. Research firm CoStar also reported a slight quarter-over-quarter decline, although to a much lesser extent at 2.25 percent across office, industrial, retail and apartment properties.

“One of the reasons we don’t believe that the dip in second quarter CRE sales represents a huge problem is that our second quarter results were very strong across the board,” says Muoio. “We had year-over-year and quarter-over-quarter increases in the number of properties brought to auction, the number of properties sold and the overall deal volume,” he says.

The dip can most likely be attributed to a variety of factors, ranging from a natural lull after a period of very active sales in both first quarter of this year and fourth quarter of 2014. Typically, following a fourth quarter rush to close deals before year-end, first quarter sales slow as investors reset for the new year.

The dip can most likely be attributed to a variety of factors, ranging from a natural lull after a period of very active sales in both first quarter of this year and fourth quarter of 2014. Typically, following a fourth quarter rush to close deals before year-end, first quarter sales slow as investors reset for the new year.

“This year, deal volume increased in the first quarter from the strong fourth, so the slippage in the second quarter was not unexpected,” says Muoio. The $131.0 billion in sales that occurred in the fourth quarter was followed by an additional $137.2 billion in transactions in the first quarter, according to RCA.

Other contributing factors to the second quarter decline could be the widening of CMBS spreads and volatility in the global economy due to slower growth in China. A shortage of for-sale inventory is another likely culprit.

“I think that may be a challenge for the markets going forward in terms of maintaining the types of volume that we have seen in the past couple of years. There is just less product out there transacting,” says Brian Ward, president of capital markets and investment services with commercial real estate services firm Colliers International.

The market may be nearing a plateau where the high levels of sales simply may not be sustainable in a maturing market. In addition, there are also those owners who are reluctant to sell because they are concerned about the challenges of redeploying the capital, says Ward.

The bigger question is whether the market can expect a healthy bounce with higher deal flow in the latter half of the year, or whether some of these factors will continue to be a drag on deal flow.

“There is a clear slowdown, and that has continued through July and August,” says Tom McNearney, chief investment officer at real estate services firm Transwestern. Sales are still up year-to-date across all property types. However, sales during the month of August, for example, were actually down about 2 percent year-over-year, notes McNearney.

“I am not concerned that this represents some kind of meltdown, but it is not surprising given some of the things going on,” he says. On the upside, there is still good liquidity in the market, property fundamentals continue to improve and real estate remains an attractive investment compared to alternatives such as stocks and bonds. Yet talk of a potential Fed rate increase has injected uncertainty into the market. Added to that, there are some other factors at play that could be skewing the numbers a bit. For example, there is a notable shift of investor capital to secondary and suburban markets, which are generally priced lower than major gateway properties, as well as an increase in investment dollars going into new development projects, adds McNearney.

“I still think that you are going to see a big spike in volume in late third quarter, and I think fourth quarter is going to be huge,” says Ward. The last two fourth quarters, both in 2013 and 2014, ended with massive sales volume, and that is likely to be the case again this year with investors pressured to place capital by year-end.

“I don’t see second quarter as a systemic indication of the market. It is more of an aberration,” he says. However, the constrained supply is still an issue that is going to impact markets a little bit more next year. “There is still an overabundance of liquidity. The challenge is finding good deals."