- Clarion, MHP Take to Manhattan’s Financial District “Clarion Partners and joint venture partner MHP Real Estate Services (formerly Murray Hill Properties) have become the proud new owners of the 1.2 million-square-foot Manhattan office tower at 180 Maiden Lane, having shelled out approximately $470 million for the privilege.” (Commercial Property Executive)

- New York Plaza’s Jailed Owner to Raise Bail Loan from Mirach “Sahara India Pariwar, the troubled Indian financial-services group, is set to raise $1.05 billion from Mirach Capital Group by mortgaging three hotels including New York’s Plaza to help pay bail of its jailed founder Subrata Roy.” (Bloomberg Businessweek)

- CREFC 2015: What Worries the CRE Finance Industry “Among the concerns: a need for increased transparency in bonds backed by real estate loans, the fate of non-Gateway markets, risk retention, “edgy” underwriting and the erosion of appraisal standards.” (Commercial Observer)

- Atlanta Industrial Real Estate Market Had its Best Year Since the Late 1990s “Atlanta, the largest market for industrial buildings in the Southeast at 600 million square feet, experienced the highest total net absorption in 16 years, according to real estate services giant CBRE Inc.” (Atlanta Business Chronicle)

- Best Buy Cities: Where to Invest in Housing in 2015 “Whether you’re an investor looking to pick up a few rental properties or a young professional interested in purchasing a first home, there are plenty of places where housing should be a pretty safe bet.” (Forbes)

- Foreign Money Floods Boston Real Estate Market “Foreign buyers spent $4.2 billion in deals for office properties that included buyers from Canada, Norway, Japan, Chile, Switzerland, Ireland, the Netherlands, France, Hong Kong, Japan and Singapore. That was up from $1.3 billion in 2013.” (Boston Herald)

- Family Dollar: Dollar Tree Bid is a “Virtual Certainty” “Family Dollar Stores Inc. on Monday urged shareholders to approve the $8.5 billion takeover offer from smaller rival Dollar Tree Inc., arguing that closing the deal is a ‘virtual certainty’ compared to the higher bid from larger peer Dollar General Corp.” (The Wall Street Journal)

- Macy’s and J.C. Penney Announce Store Closings: Who’s Next? “More people shopping and surfing for deals on mobile devices, population shifts and the emergence of new competitors headline the list of reasons why well-established major retailers continue to re-think the number of physical stores they operate in the U.S.” (The Street)

- Why is CRE Using CRE Marketing Strategies? “New methods are becoming more commonplace as the commercial market gets hot again—especially with creative space—and as some offices adopt residential qualities including indoor/outdoor space, balconies, lofts, kitchens and places for pets.” (GlobeSt.)

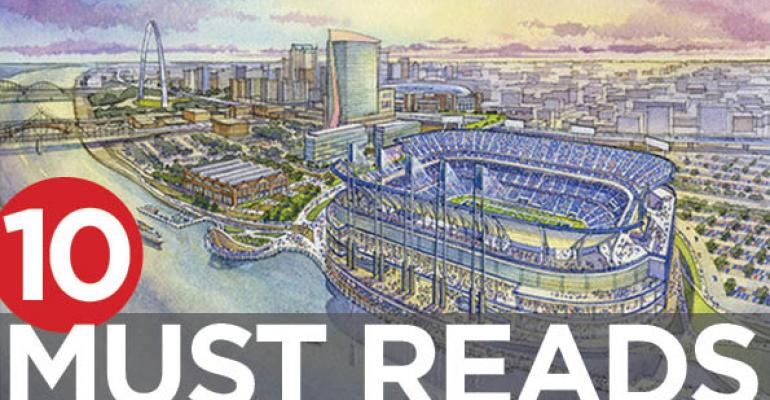

- St. Louis Pitches Stadium Plan to Keep Rams “The approximately $900-million, 64,000-seat stadium would sit on 60 acres along the Mississippi River, between downtown and a brand-new bridge, with views of the Gateway Arch and the ability to also house a Major League Soccer franchise.” (Los Angeles Times)

0 comments

Hide comments