It is no surprise that there is stiff competition and a shortage of supply of sale-leasebacks and net lease properties.

“Across all product types in real estate, there is no shortage of capital, whether it be institutional or private looking for good, quality real estate deals,” says Mark West, senior managing director at HFF, a commercial real estate capital intermediary firm. “And in the net lease, sale-leaseback space it is very attractive, and plenty of capital is looking for the long-term, predictable cash flow that is represented by sale-leasebacks.”

Institutional quality deals priced between $30 million and $200 million are generally attracting about eight to 12 legitimate bidders, West adds.

“It has become increasingly difficult to find people who are willing to sell in Miami. It’s quite the reverse, everybody wants to buy rather than sell,” notes José Antonio Lobón, an associate with the CBRE capital markets institutional group in South Florida. As a result, there is a scarcity of inventory on the market.

“So when it does hit the market, it is very aggressively pursued by the traditional buyer pool,” Lobon says. Pension fund advisors, insurance companies, private equity groups, offshore buyers and local operators are all competing for the assets.

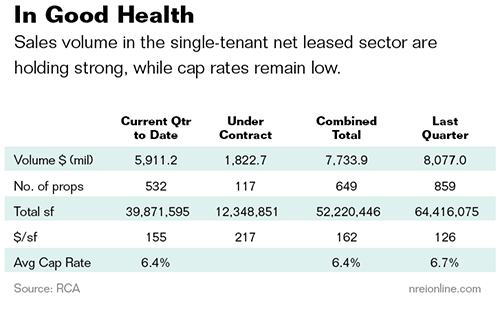

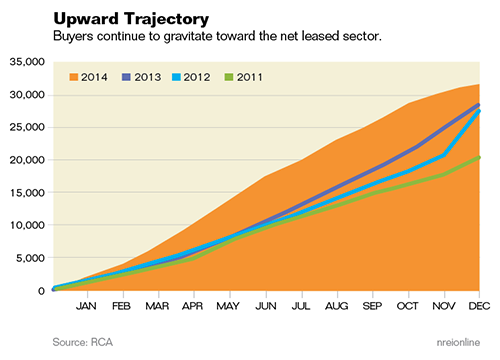

The year-to-date volume of sale-leaseback transactions that have closed totaled about $9.4 billion as of early December, according to data from Real Capital Analytics, a New York City-based research firm. That’s down 14 percent compared to the same period in 2013. However, the figure did not account for an additional $619 million in sale-leaseback properties currently under contract.

“From the owner perspective, we have seen a high potential of sales, as owners have made it through the depression and have decided to capitalize on current market conditions,” says Devin B. White, a vice president at CBRE in Miami. Property values have improved and it is a good time for owners to monetize those assets and reinvest the capital back into their businesses as they look to expand or grow operations, he says.

For example, CBRE recently arranged the off-market sale of a184,210-sq.-ft. bulk storage facility in Miami occupied by International Data Depository, a document storage company. New York-based Gramercy Property Trust purchased the property for $10.1 million.

Looking for higher caps

Many sale-leaseback deals have already hit the market. CBRE’s South Florida office has been involved in about a dozen sale-leaseback transactions over the last few years, but that actively has dropped off noticeably in the past 12 months.

“I think that speaks to the market. We made it through the depression and a lot of the owners that made it out sold,” says White. “Now it seems like there is no inventory to sell, but there are so many more buyers and buyer profiles looking to buy.”

The competition for net lease properties is prompting investors such as W.P. Carey to acquire assets directly from developers and investors that are selling out to take advantage of gains.

“Sale-leasebacks and traditional net-lease deals that we have done still exist, and we are still actively looking at a number of them, but in our opinion, the risk return on some of the existing net lease deals or developer deals is just better than the sale-leaseback deals that are out there,” says Gino Sabatini, managing director and co-head of global investments at W.P. Carey Inc.

One reason those existing net lease properties are attractive buys is because they have shorter terms remaining on leases compared to new sale-leaseback deals. The shorter lease terms often translate to higher cap rates. Earlier this year, W.P. Carey purchased an industrial building in Industrial Park, Ill. outside of Chicago from Fulcrum Asset Advisors. The distribution facility is leased for 10 years to an affiliate of Solo Cup. The seller had expanded the facility in 2005, extended the lease and was ready to trade out of that property, notes Sabatini.

W.P. Carey purchased the property for $85 million, or $51 per sq. ft. The 10-year lease for Solo Cup is shorter than going with a new sale-leaseback, which typically would carry a 15- or even a 20-year term. As such, W.P. Carey was able to buy the Solo Cup facility at a 7 percent cap rate. If it was done as a corporate sale-leaseback with a longer lease term, the cap rate would have been much lower, perhaps at 6.5 or 6 percent, notes Sabatini.

“More importantly, our $51 per square foot number we think is terrific,” he adds.