In its 2012-2013 tax roll assessment, New York City has once again reported major increases in property values. Bucking the national trend toward flat or downward value changes, the city in January found that overall market value had grown to more than $876 billion, up by more than $31 billion from last year’s record $845.4 billion.

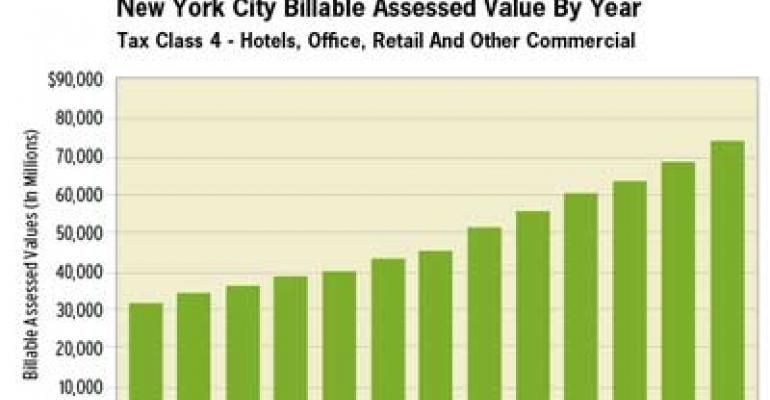

Remarkably, the taxable assessment (approximately 45 percent of market value) is only the latest step in a relentless series of increases in the taxpayers’ burden, dished out each and every year since 1995. Bar graphs of total assessed values for each year by property class reveal the linear, uninterrupted nature of the changes, with nary a hint of the variations that would be expected during the two most recent economic recessions. (See chart.)

Last year’s assessment increase provoked an angry backlash from both residential and commercial property owners. As a result of these widespread protests, the New York City Department of Finance agreed to voluntarily roll back assessments of cooperatives and condominiums (owned by voting taxpayers) that experienced assessment increases of 50 percent or more, choosing to instead limit increases on those properties to no more than 10 percent over the prior year. Properties that had received an assessment increase of 49 percent or less, however, went unchanged onto the 2011-2012 roll.

The Department of Finance had to correct 30,457 property assessments, and the Tax Commission handled 50,022 appeals covering 183,811 separately assessed tax lots. The Tax Commission's remedial actions yielded $560 million in tax relief to aggrieved taxpayers.

Repeat performance?

With the tentative assessment for the tax period running from July 1, 2012, through June 30, 2013, and showing dramatic value increases yet again for certain residential properties, there is a flurry of legislative activity promoting a new class of property for cooperatives and condominiums. As proposed, this class would have its tax increases capped at no more than 6 percent each year, the same treatment now accorded to one-, two- and three-family homes.

This legislation, if passed, still won’t eliminate the precipitous disparity in taxes between apartments and homes. The cap on homes has been in effect since 1982, and now most homes are assessed at a very small fraction of their current market value.

Citywide, the taxable assessed values of one-, two- and three-family homes (Class 1) increased 3.11percent from last year’s assessment. Rental apartments, co-ops and condos (Class 2) are up 5.15 percent, and office, hotel, retail and other commercial properties (Class 4) are experiencing an increase of 7.26 percent.

A red flag

Before publication, the Department of Finance detected massive errors in the assessment roll and delayed its release. Officially, the Department of Finance cited the need “to correct an error in one of the computer systems it uses to calculate values.” But insiders report that quality control issues were also a factor in the delay. On Jan. 19, 2012—two days late—the Department of Finance published the city’s tentative assessment roll, covering more than 1 million separately assessed parcels of real estate.

The New York City Charter grants property owners the right to protest their tentative assessments from Jan. 15 (or the first day following weekends and/or holidays) until March 1. The law authorizes owners of one- to three-family houses the right to contest their tentative assessments until March 15. The protests must be filed during these time periods with the New York City Tax Commission, an independent city agency authorized to review and correct the Department of Finance’s property tax assessments.

In announcing the delayed assessment release, Finance Commissioner David M. Frankel stated that “we will keep the roll open for an additional two days this year.” The Tax Commission’s legal authority to review protests filed after March 1 and March 15 is questionable, however. In the absence of remedial legislation expressly authorizing the Tax Commission to review protest applications filed after March 1 and March 15, applicants are better off assuming that the current statutory filing dates will continue to govern.

Commercial consternation

During the period after the publication of the tentative assessment and prior to the publication of the final assessment roll on May 25, the Department of Finance is permitted to increase assessed values of nonresidential properties. This authority may only be exercised until May 10, however, and only where the department has mailed written notice to the owner at least 10 days prior to May 10. The mailing of such notices after Feb. 1 extends the protest period for affected owners, who have 20 days after the notice was mailed to apply for a correction of their assessment.

In Frankel’s announcement, he also mentioned that the Department of Finance is reviewing whether thousands of properties which have historically enjoyed not-for-profit exemptions remain eligible for such benefits. Previous exemptions for many properties which did not file timely renewal applications prior to Nov. 1, 2011, were removed on the tentative assessment roll, but Frankel advised that these properties can still regain their exemptions for the 2012-2013 tax year if they provide the required documentation by Feb. 13.

Joel R. Marcus is a partner in the law firm of Marcus & Pollack LLP, the New York City member of American Property Tax Counsel.