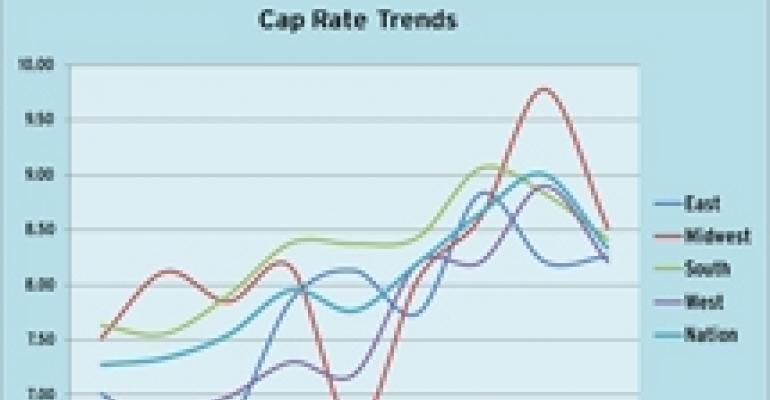

An uptick in investment in top retail properties helped send average cap rates for the sector down for the first quarter.

Overall, the national cap rate decreased 24 basis points in the first quarter of 2010 to 8.34 percent, according to data from Valuation & Advisory Services. It is the first major decline that the brokerage firm has measured in three years. The data jibes with other reports that indicated an improvement in the investment sales climate driven primarily by transactions on class-A assets. In fact, some analysts have speculated that since the most closings are for the best assets, it is skewing the data a bit. If more deals were closing on class-B or class-C centers, average cap rates would be higher.

The Midwest was the region with the sharpest compression in cap rates. There, cap rates lurched downward by 126 basis points, the largest quarterly move recorded since the first quarter of 2003. “Rate increases seemingly had to stop at some point, and it appears some form of stabilization in the market is at hand,” CBRE wrote in its report. “Average rates are now comparable to Q2/Q3 2009. While it is too early to tell, Q4 2009 may have been the cap rate peak during the current cycle.”

Cap rates also fell sharply in the West—from 8.90 percent to 8.21 percent. Cap rates in the East, however, actually rose slightly from 8.21 percent to 8.26 percent. Cap rates also fell in the South from 8.83 percent to 8.41 percent.

The data points in CBRE’s results are confirmed closed transactions, adjusted for assumed financing, and are used to reflect overall market trends.