The commercial real estate recovery, like the rest of the economy, had a late spring slowdown. “We had a strong first quarter and a softer second quarter as investors became concerned about sovereign debt issues,” says Janice Stanton, senior managing director of Capital Markets for commercial real estate broker Cushman & Wakefield.

Commercial real estate brokers and researchers see a similar stall in momentum. The strongest activity is still confined to a few large cities, but large parts of the rest of the country are still working out the wreckage of the real estate crash.

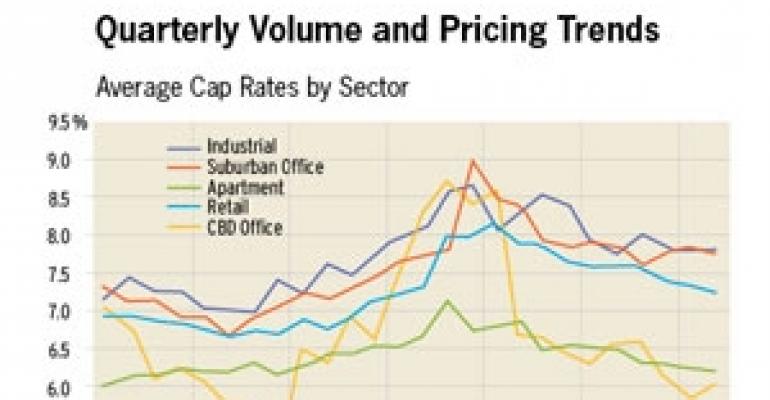

“Momentum has tempered,” says Dan Fasulo, managing director for data firm Real Capital Analytics. “We are not seeing the year-over-year gains that we were seeing last year.” Real estate investors traded $108 billion in properties in the first half of this year, according to Real Capital. The number is either up 6 percent, excluding transactions associated with mergers and acquisitions, or it was down 17 percent, including the boom in mergers and acquisitions last year. Either way, the market is no longer delivering clear, solid gains. Each quarter for more than a year, volume has stayed in the $50 to $60 billion range. Prices are still inching upwards for most property types, but slowly, according to Real Capital.

“Investment sales have rebounded to 2004 and 2005 levels,” says C&W’s Stanton. Investors still mainly concentrate on a few leading cities, though they are beginning to look further afield. “Gateway cities led the recovery, but increasingly investors are looking to secondary markets for yield. The focus is either on durable cash flows in secondary markets, or secondary assets in primary markets,” she says.

Stanton is hopeful for the third quarter. “The market has definitely picked up again,” she says. “C&W’s investment sales pipeline is currently up about 30 percent on a year over year basis.” International buyers are helping. “The U.S. has outperformed the global real estate investment markets,” she says. In contrast, global activity is down almost 20 percent on a year-over-year basis.

However, the availability of financing still confines some investors into a few leading cities. The conduit lending business that investors depended on to finance class-B and class-C properties has still not fully recovered from the crash in commercial mortgage-backed securities. “CMBS is expanding in fits and starts, but not way the market needs,” says Real Capital’s Fasulo.

However, there is some good news for financing. Local and regional banks are beginning to step into the gap in some markets—even in places where most of the properties for sale are distressed assets.

For example, Sperry Van Ness Broker Jennifer Donathan closed three times as many deals in the first half of 2012 as she did last year. In July she helped close the deal to buy the Glenwood Apartments, a 50-unit apartment property in Cincinnati, for $440,000. That’s about half the $900,000 price that the seller had paid for the Glenwood back in the boom years. “The bank took a huge haircut,” says Donathan.

Most of the 18 deals Donathan completed in the first half of 2012 are class-C assets at least as distressed as the Glenwood Apartments, she says. The owners of class-A and class-B properties are still much less likely to offer their properties for sale in her part of the country. "I think they are waiting for the market to come back stronger,” she says.

Financing for these distressed assets has become much easier to find. Traditional banks have begun to provide acquisition financing again, though they demand loan-to-value ratios of 70 to 80 percent. “More buyers are pre-approved,” Donathan says.