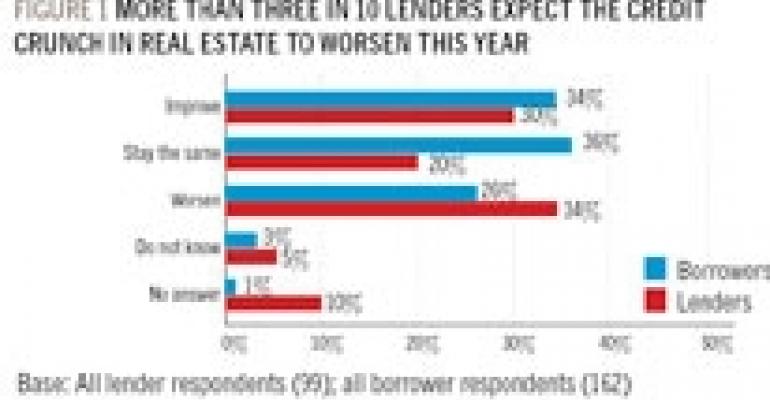

Borrowers are less optimistic now than they were a year ago on the issue of whether the credit crunch in commercial real estate will ease over the next 12 months. The percentage of borrowers who expect the credit markets to improve over the next year dropped from 53% in 2008 to 34% in 2009, according to an exclusive survey conducted by National Real Estate Investor and Penton Research.

The outlook among lenders is even more pessimistic. More than three out of 10 lenders expect the credit crunch to worsen this year [Figure 1], and 58% say that it will take 19 months or longer for liquidity to return to the capital markets in a normalized fashion.

Borrowers' souring mood doesn't surprise Jon Benowitz, managing director with Columbus, Ohio-based Rockbridge Capital, a hotel lender and equity investor.

“I attribute most of that to unrealistic expectations. The credit markets were extremely lenient, loose and fast moving. The world got a bit spoiled,” says Benowitz. “What we're seeing is certainly a return to caution, to slower and more time-consuming underwriting.”

The seventh annual Borrower Trends Survey conducted Dec. 9 to Jan. 5 included responses from 162 borrowers and 99 lenders for a total of 251 survey participants.

This year's survey marks the first time that lenders were asked to participate. More than two-thirds of lender respondents are either financial intermediaries or direct lenders, and the rest are private investors.

Among the survey highlights:

Lending volume dropped dramatically in 2009. In fact, 44% of lenders say that the total dollar volume of loans closed in 2009 decreased 20% or more over the prior year [Figure 2].

-

Borrowers have a median $24.2 million in commercial real estate assets. Nearly one-fourth report that they have commercial real estate assets of $100 million or more [Figure 3].

-

Loan-to-value ratios have decreased over the past year. Respondents indicate that 12 months ago typical loan-to-value ratios were 75%, and now average less than 70%.

-

Refinancing activity has been most prevalent over the past 12 months. Financing for new development and renovation has decreased from the peak levels of 2007, while lending for refinancing/consolidation has increased [Figure 4].

-

Lenders indicate that 62% of loans closed over the past 12 months have been recourse versus 38% non-recourse. Borrowers say 53% of their debt is made up of recourse loans, and 22% expect that figure to rise over the next 12 months.

-

Borrowers and lenders expect that long-term, fixed-rate mortgages will rise over the next 12 months [Figure 5]. How much? Well, they say 1.1% on average.

-

What's hot and what's not?

-

The multifamily sector enjoys widespread appeal in the financing community [Figure 6]. More than six out of 10 lenders (65%) say apartments offer the best investment opportunities, followed by medical office (25%) and industrial properties (22%).

Lenders are much more bearish on hotels, however. When asked which property types they exercise the most caution toward when reviewing loan applications, lenders most frequently cited hotels (50%), followed by undeveloped land (36%) and retail malls (32%).

Robert Habeeb, president and COO of First Hospitality Group based in Rosemont, Ill., says he is surprised that the cautious sentiment expressed by lenders toward hotels wasn't even more pronounced.

“I thought the number would be almost 100%. Lenders are being very cautious, and they're pricing loans a little bit more consistent with the risk,” says Habeeb.

There is one trump card that apartments hold over the other property types from a financing perspective. Government-sponsored enterprises Fannie Mae and Freddie Mac, not to mention HUD, have continued to provide debt capital to the sector during the economic downturn.

Just ask Gary M. Tenzer, principal and co-founder of George Smith Partners, a real estate investment banking firm based in Los Angeles. During the past year alone, Tenzer personally arranged $250 million in financing for apartment communities in Southern California. All of it was done through Fannie and Freddie. The properties were principally Class-A buildings in well-located areas.

There is another reason that apartments are an attractive property segment, says Tenzer. “When the economy begins to recover, this sector picks up very quickly. The income side of the business is soft right now, but that will respond quickly when employment resumes.”

One property sector that continues to experience strong demand from both tenants and commercial real estate investors alike is medical office, and that trend is reflected in the survey results.

Jim Clark, managing principal of Chicago-based EnTrust Realty Advisors, the brokerage and capital markets affiliate of The Alter Group, says the risk profile of medical office is what appeals to lenders.

Medical office properties, which include surgical centers and outpatient facilities, tend to be relatively small, say 75,000 sq. ft., and sell for $5 million to $7 million, says Clark. That means lenders are putting much less capital at risk than if they were to lend on an office high-rise or other major developments.

Perhaps the strongest selling point is that many medical office properties are located on hospital campuses, so there is a major anchor already in place that experiences continual demand.

“Remember that medical office buildings tend to have a very stable tenant base that is averse to moving too often. Physicians rely on being close to their patients and their affiliated hospitals, so the prospect of moving isn't one they take lightly,” says Clark.

In 2008, EnTrust Realty completed the sale of Terrace Park Professional Center, a 59,615 sq. ft. medical office building developed by Alter+Care in Bettendorf, Iowa. The purchaser was Dallas-based RM Crowe Co.

The Class-A medical office building is 80% leased, and draws patients from within a 60-mile radius. The center is connected to the 150-bed Trinity at Terrace Park Hospital, the newest hospital in the Quad Cities.

Hierarchy of needs

When seeking a loan origination firm, borrowers indicate that certainty of execution is the most important factor, followed by flexibility of loan terms and lowest available rate [Figure 7].

First and foremost, borrowers want assurance that the loan will close and that the lender won't alter the terms quoted on the loan application, says Tenzer of George Smith Partners.

The act of lenders reducing the loan amount or increasing the spread over 10-year Treasuries prior to the deal closing is known as retrading a loan.

On the surface that may sound like the lender is being greedy, but other factors may be at play, says Tenzer. “It may be that when they get to the underwriting, lenders find things about the transaction that they didn't know.”

When the commercial mortgage-backed securities (CMBS) market was in its heyday, some conduit lenders would routinely retrade loans. “I think that was sort of the Wall Street culture,” says Tenzer.

“That's not to say that banks and other lenders wouldn't change loan terms, but I think that it's being done less for opportunistic reasons and more out of necessity as they understand the deal better,” concludes Tenzer.

With a much more limited array of debt capital sources than in years past, certainty of execution takes on heightened importance, says Clark of EnTrust Realty Advisors.

What's more, many borrowers with maturing loans are racing against the clock. “You want to know the lender you are working with is going to get the deal done,” says Clark.

Fear, the X factor

Borrowers cite economic conditions and loan-to-value ratios as the two factors that have most affected their ability to obtain financing over the past year [Figure 8]. The government takeover of Fannie Mae and Freddie Mac has had the least effect.

A lender is not going to provide debt financing if he has serious doubts that he will get paid back, says Clark of EnTrust. Thus, the strength of the economy is inextricably linked to income generation at the property level and the confidence of the lender.

Lenders have tightened up on loan-to-values — which remain a moving target — because property values have dropped significantly from their peak levels, explains Clark.

“When there is a consensus that valuations throughout the market have been adequately readjusted, that there is a new water level, then there will be a little more inclination to be aggressive on loan-to-values because there will be a perception that values are going to increase,” says Clark.

The fear factor is playing an equally big role in today's lending market, says Habeeb of First Hospitality Group. He is referring to the controversy swirling around banks, lenders and investment groups in Washington, D.C. in the wake of the global financial meltdown, the ensuing finger pointing over who is largely to blame and the growing drumbeat for reform.

“I think all this evolves into overregulation,” says Habeeb. “The natural outcome of what we are seeing in the administration's anger toward banks and the hearings as to who's at fault is that we will probably have a round of very restrictive lending regulations, and I think it's coloring a lot of banks' judgment as they look at their portfolios.

“The banks are all uber-conservative,” Habeeb continues, “because they all expect something is going to come down the pike that is going to make it very punitive to make speculative loans.”

Slightly more than one in five lenders (22%) have increased their allowance of loan assumptions over the past year. What's more, 23% expect to increase their allowance of loan assumptions in the coming year. Another 28% of lenders are unsure whether they will increase, decrease or maintain the current levels in 2010.

Lenders get creative

A loan assumption occurs when the buyer of a commercial real estate property essentially fills the shoes of the seller and agrees to the loan terms already in place. The lender has wide discretion in the matter.

“The reason we're seeing more loan assumptions is that it's the best alternative right now,” says Benowitz of Rockbridge Capital. For a lender with a maturing loan that can't get paid off, there is an opportunity to move away from a poorly capitalized borrower who is overleveraged to one that is financially much better off.

“Maybe the lender doesn't get paid on a maturity date, but it gives the lender a better plan and better collateral because the borrower is better,” says Benowitz.

With loan maturity defaults looming large in the year ahead, Rockbridge sees a big investment opportunity in today's extremely tight lending market.

“Perhaps we can take an ownership interest, a preferred equity position, or a mezzanine debt position,” explains Benowitz. “Part of our new capital can go to pay down the first mortgage lenders, so that they are a bit more comfortable going forward.”

Under this scenario, the borrowers also are better off, emphasizes Benowitz. “Their overall debt balance has not increased. “They've gotten past the maturity date and recapitalized the deal that works for everyone.”

Matt Valley Is Editor of NREI

Survey Methodology

Data for the seventh annual Borrower Trends Survey was collected between Dec. 9, 2009 and Jan. 5, 2010. Penton Research sent an e-mail invite to NREI print and e-newsletter subscribers to participate in the online survey. Requests for participation were also included in NREI weekly newsletters.

The purpose of the survey was to quantify the overall level of financing activity and gauge borrowers' satisfaction with the loan process. The survey also sought to compare and contrast the responses of borrowers and lenders on several key issues, including the credit crunch, loan-to-values, interest rates, and government efforts to stimulate the economy and lending.

The survey yielded 261 responses, including 162 borrowers and 99 lenders.

-