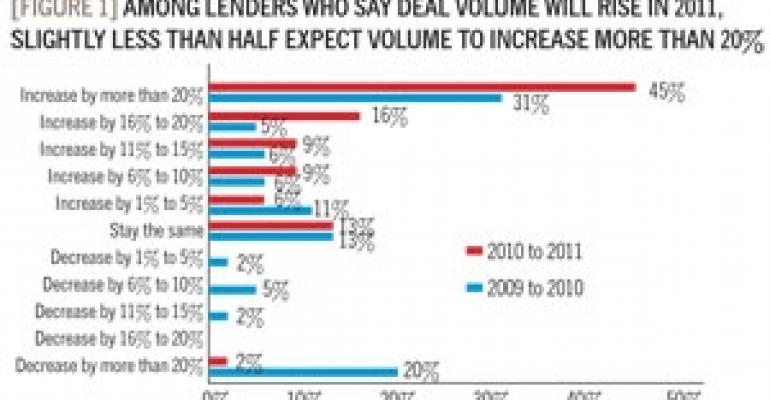

More than half of lenders (59%) say that the total dollar amount of commercial and multifamily loans closed by their firms in 2010 rose over 2009 levels, and an overwhelming majority (85%) expect lending volume to increase in 2011, according to an exclusive NREI survey. Among lenders who predict an increase over the next year, 45% anticipate that loan volume will surge by more than 20% [Figure 1].

The seventh annual Borrower Trends Survey reveals that the deep freeze in the capital markets that stymied commercial real estate investment in 2008 and 2009 has begun to thaw. Both lenders and borrowers were much more active in 2010. That momentum is expected to build in 2011, but not evenly across the industry.

The turnaround is welcome news to property owners, investors and developers. Conservative lending practices that emerged in 2008 in the wake of the capital crisis have left many borrowers out in the cold. The limited capital that was available was flowing predominantly to top-quality properties with high occupancy rates and creditworthy tenants in major metros.

“What we saw in 2010 is a bit of a rebound, and the rebound includes a broader segment of the market that is now considered financeable,” says Ed Padilla, CEO of Bloomington, Minn.-based NorthMarq Capital. The firm arranged $6.6 billion in financing in 2010, a 33% increase over 2009.

Seven out of 10 borrower respondents were active in the debt markets in 2010, up from 60% a year ago. Both borrowers and lenders are optimistic that credit will be more accessible in 2011. Overall, 61% of borrowers and 74% of lenders expect credit to be more available over the next 12 months. The survey conducted between Dec. 15, 2010 and Jan. 5, 2011 yielded 158 total responses.

“The lending market is coming back and it is coming back across the spectrum of various lenders, which is a good sign,” says Nicholas Bienstock, a managing partner at Savanna, a private investment firm based in New York. Savanna secured three loans in 2010 totaling $211.5 million with different lenders that include Deutsche Bank, Morgan Stanley and private equity firm PCCP. Savanna is working on a fourth loan. That deal is expected to close in the first quarter of 2011.

Savanna is seeing a resurgence of lenders who are willing to fund the riskier value-added investment opportunities that the company favors. All four of its loan applications have attracted interest from multiple lenders.

Savanna recently secured a $58 million loan from PCCP for its 386 Park Avenue South, a 20-story office building in New York. Savanna and its partner, Monday Properties, acquired the office tower in May in an all-cash deal. The partnership is now putting short-term debt on the property as it works to stabilize the asset through capital improvements and leasing activity.

Refinancing drives activity

Despite signs that financing activity is increasing, capital is far from flowing freely. Refinancing continues to drive a large portion of the financing activity. More than four in 10 borrowers (44%) have received funds for consolidation and refinancing purposes over the past 12 months [Figure 2].

Surprisingly, 26% of borrowers surveyed have received funds for new development, followed by 25% who have borrowed for acquisitions. Some 23% of borrowers have obtained financing for renovation.

In addition, lenders remain conservative in their deal making. “From a capital markets perspective, though definitely recovered, that recovery is not across the board,” says John Pelusi, executive managing director and a managing member of Pittsburgh-based Holliday Fenoglio Fowler. “There are areas in the Midwest and the Rust Belt, for example, where it is very difficult to get deals done, especially on transitional assets.”

Requests for refinancing and consolidation loans are finding the most success as lenders scrutinize all applications carefully. Slightly more than four in 10 refinancing loan requests (42%) are closed, followed by acquisition loans (39%), and renovation and redevelopment loans (27%), report lenders. Only about one in five construction loan requests (19%) closes today.

“The low interest rates during 2010 drove a lot of volume for institutional and other well-capitalized firms who looked at the opportunity to recapitalize their balance sheets, and to lock in the current long-term fixed rates,” says David Durning, senior managing director of Newark, N.J.-based Prudential Mortgage Capital.

“During the second half of the year, we began to see more financing that was driven by some acquisition activity, particularly on the multifamily side,” Durning adds. Although Prudential hasn't disclosed its final lending volume for 2010, it expects to meet its original projection of $7.5 billion. That's a 24% increase over the $5.7 billion Prudential originated in 2009.

Bullish on apartments

Apartments represent the most active loan type among both borrowers and lenders. Three out of four lenders say apartments offer the best buying opportunities today [Figure 3]. One reason is the availability of financing through the government-sponsored enterprises Fannie Mae, Freddie Mac and the Federal Housing Authority. Lenders also have more confidence in apartments due to the recovery in rents and occupancies that the sector has already experienced.

Some 42% of lenders say seniors housing hold the best buying opportunities, followed closely by medical office (41%). On the flip side, nearly six out of 10 lenders (58%) say that they exercise the most caution when reviewing hotel loan applications, closely followed by undeveloped land (54%).

Permanent loans also dominate financing activity among both borrowers and lenders. The low interest rate environment is motivating borrowers to lock in current rates over the long term. Sixty percent of borrowers secured long-term loans over the past 12 months, followed by 44% who obtained construction (short-term) loans, and 31% who established lines of credit. Consistent with 2009 activity, a much smaller number of borrowers also opted for preferred equity (8%), second mortgages (8%), and mezzanine loans (5%).

Although the 10-year Treasury yield jumped nearly 100 basis points in a two-month period to hover around 3.4% as of early January, borrowers are still finding mortgage rates at incredibly low levels. Quality properties generating a steady cash flow and stable or rising net operating income are benefiting the most from the competition and aggressive rates.

“I have been doing this for 31 years, and when you put those quality assets out on the market I have never seen rates as low as what we saw in 2010,” Pelusi says. HFF closed some low-leverage loans at rates that dipped to 3.5% for five-year loans and 4.5% for 10-year loans. “That is pretty remarkable given the fact that the economy, although stabilized, is still very difficult with high unemployment.”

The majority of respondents expect an increase in both short-term and long-term mortgage rates in the coming year. More than three-fourths (78%) of respondents expect long-term rates to increase in 2011, which is slightly higher than the 73% who held the same view a year ago [Figure 4].

Overall, borrowers and lenders expect long-term mortgage rates to rise by an average of 1.2% over the next 12 months. Respondents have a similar view on short-term rates, with 74% predicting an average increase of 1.1% in the coming year.

Signs of life for CMBS

Similar to past surveys, commercial banks and savings institutions continue to be the most popular source of capital with 79% of borrowers accessing funds from those institutions in the past 12 months. Nearly three out of 10 borrowers tapped private investors for financing, followed by Fannie Mae and Freddie Mac (16%) and institutional investors (11%).

The commercial mortgage-backed securities (CMBS) market began to stir in 2010 with 7% of borrowers tapping that financing source. While that level of activity is down from 11% in both 2007 and 2006, it does represent a significant turnaround from the miniscule 2% of borrowers who received securitized loans in 2009.

The return of CMBS lending has broader implications for the commercial real estate sector as a whole. CMBS loans help improve liquidity in the capital markets and relieve the pressure on other financing sources, especially at a time when the industry is facing a wave of maturing debt.

CMBS issuance in the U.S. totaled $11.6 billion in 2010, according to industry newsletter Commercial Mortgage Alert. “Our expectation is that CMBS will play a significant part in the amount of property financed in 2011, somewhere between $30 and $40 billion,” says Padilla of NorthMarq. “Although that is nowhere close to the $200-plus billion financed in 2007, it's still a significant amount of dollars.”

Another positive development for borrowers is that underwriting standards appear to be loosening. About 60% of loans closed over the past 12 months have been recourse versus 40% non-recourse, according to lenders. In the coming year, they expect 53% of loans originated to be recourse versus 47% non-recourse. Meanwhile, loan-to-value ratios rose slightly from 66% in 2009 to 69% in 2010, lenders report.

Assessing government's impact

Although the debt financing market has begun to heal, it still faces major challenges. The pace of the economic and real estate recovery, government reforms, and rising interest rates are just a few of the factors that will influence the availability and cost of capital in the coming year.

So far, borrowers and lenders are split on what impact actions taken by the U.S. and other foreign governments to stabilize financial markets will have on their ability to secure or provide financing in 2011.

One-third of lenders and 39% of borrowers believe that the Federal Reserve's second round of quantitative easing (QE2) will increase their ability to secure or provide capital, while 15% of borrowers and 13% of lenders believe it will decrease their ability to secure and provide financing.

Borrowers are particularly pessimistic about the impact that financial regulatory reform legislation will have on the real estate industry. Some 53% of borrowers and 41% of lenders expect the legislation to decrease their ability to secure or provide financing [Figure 5].

While real estate fundamentals are only now beginning to recover in the wake of the Great Recession, it's clear that borrowing expanded in 2010 and is expected to grow in breadth and depth in 2011.

“Lending is still nowhere near where it was from 2004 to 2007, where people could underwrite risk regardless of where a property was located,” says Pelusi. “That is certainly not the case today. But every day the box gets a little bigger.”

Beth Mattson is a Minneapolis-based writer.

Survey Methodology

For the seventh annual 2010 Borrower Trends Survey, NREI e-mailed print and e-newsletter subscribers with an invitation to participate in the online research conducted between Dec. 15, 2010 and Jan. 5, 2011. Requests for participation were also included in weekly NREI e-newsletters. A total of 89 borrowers and 69 lenders completed the survey. Borrower respondents have a median $25 million in commercial real estate assets and have borrowed a median $7.2 million in the past 12 months.