After more than a year battling an extreme credit crunch, investors have yet to see a light at the end of the financing tunnel, according to the results of a joint survey conducted in July by National Real Estate Investor, Retail Traffic, and Marcus & Millichap Real Estate Investment Services.

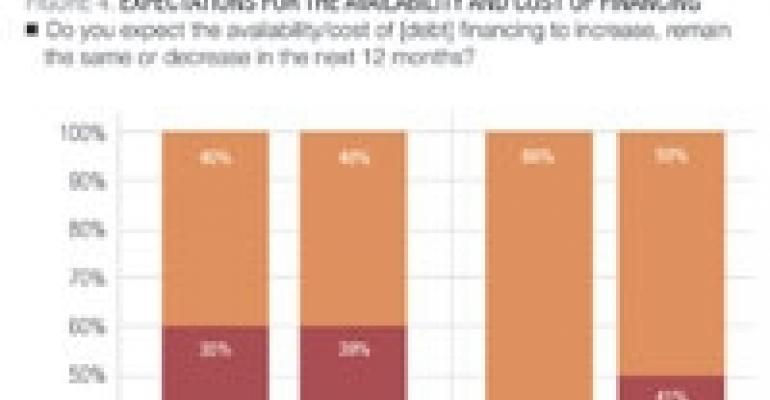

In fact, two-thirds of investors are bracing for capital costs to rise over the next 12 month, while 27% predict no change and only 6% believe costs will fall Figure 4.

The capital-constrained market continues to be one of the top concerns for investors. “Financing for major projects and purchases is either very tight or non-existent. Everyone is cautiously waiting and watching for any signs of a thaw in the icy commercial real estate industry,” writes one survey respondent.

Sentiment regarding the availability of financing has remained relatively unchanged over the past three months. Four in 10 respondents expect the availability of financing to improve over the next year, while 35% say the situation will stay the same. Nearly one in four respondents (24%) expects financing to be more difficult to obtain over the next year.

“Even though the majority of respondents think the cost of capital is going to go up, I don’t think it is going to become prohibitive,” says Hessam Nadji, managing director at Marcus & Millichap. As interest rates go up – if they do so at all in the short term – spreads are going to come in and compensate as the economy improves, he believes.

“More importantly,” Nadji emphasizes, “underwriting has changed for the foreseeable future in terms of requiring buyers to put more equity into deals and establishing adjusted market value for properties that are being financed.”