The latest edition of the Real Estate Investment Outlook, a quarterly report produced by National Real Estate Investor, Retail Traffic and Marcus & Millichap Real Estate Investment Services, shows improving capital markets sparking renewed interest across property types. There is growing confidence among investors for apartments, hotels and even the downtrodden retail sector.

Some 55% of all respondents believe that now is the time to buy apartments, followed by retail (32%), undeveloped land (29%), hotel and mixed use (26%), and office and industrial (24%).

The response to the online survey conducted between July 15 and July 30—which yielded 529 responses—shows a big boost in confidence compared with a similar survey conducted in the ,a fourth quarter of 2009.

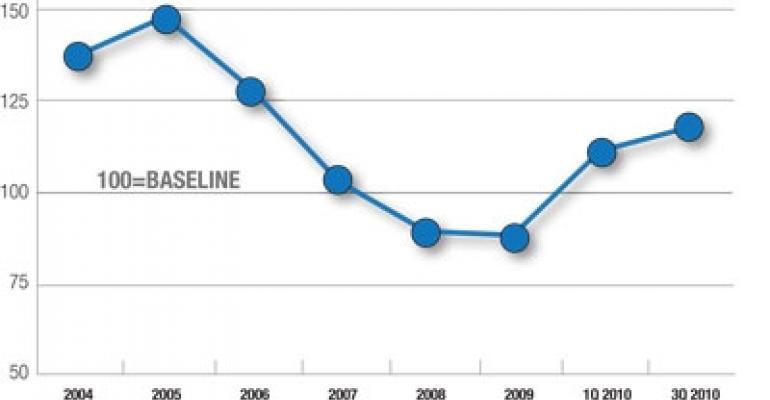

Although the industry still has a long recovery ahead, the NREI/Marcus & Millichap Investor Sentiment Index also supports the fact that investor confidence has taken a major step forward in the past year. After reaching a low point of 91 in 2009, the index has been steadily on the rise but remains below the peak of 148 set in 2005. By the third quarter of this year, the index had rebounded to 119.

Since 2004, National Real Estate Investor, Retail Traffic and Marcus & Millichap Real Estate Investment Services have conducting an Investor Outlook study that measures confidence on a host of trends, including property valuations, acquisition strategies, as well as expectations for future sales volumes.

Click here to read the full report.

In the latest survey, In July, National Real Estate Investor’s research unit and Marcus & Millichap e-mailed invitations in July to participate in an online survey to public and private investors and developers of commercial real estate. Recipients of the survey included Marcus & Millichap clients as well as subscribers of NREI and Retail Traffic selected from commercial real estate investor, pension fund, and developer business subscribers who provided their e-mail addresses. The majority of respondents are private investors (35%), developers (21%) and private partnerships (18%) with an average of $37.4 million invested in commercial real estate. REITs and institutional investors represent 5% of all respondents. The survey yielded 529 valid responses.