The news was disappointing, but not completely unexpected. Department store giant Macy’s reported that its first quarter 2016 earnings had dropped 34.0 percent, to $0.37 per diluted share, compared with $0.56 in the first quarter of 2015. Same-store sales for the period decreased by 7.4 percent, to $5.7 billion.

Like a lot of its peers, Macy’s is struggling to overcome industry changes that have shifted the center of gravity from department stores to desktops and mobile devices, undercutting the former’s relevance in the retail landscape. A report from investment banking and research firm Cowen and Company, headquartered in New York City, predicted that by 2017 online retailer Amazon.com could overtake Macy’s as the number one clothing retailer in the United States.

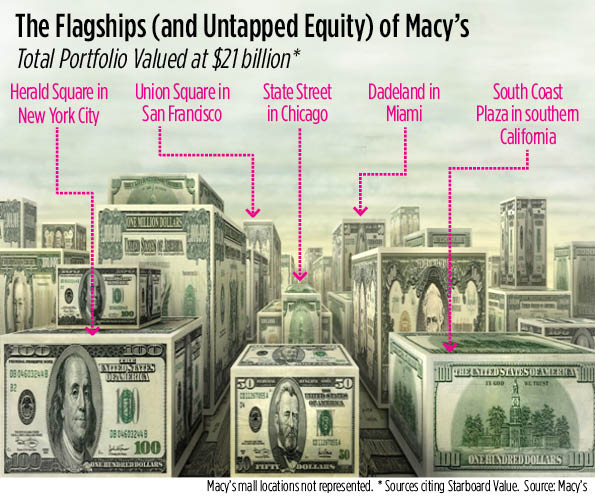

Yet many industry observers and one committed activist investor believe Macy’s already possesses the resources to potentially engineer its own rescue—its portfolio of stores. Its flagship locations in particular offer the most untapped potential, according to industry observers.

“Most of the value of their real estate is likely tied up in the urban locations like Herald Square, their Union Square location in San Francisco, the Pine Street location in Seattle and the State Street location in Chicago,” says Jim Costello, senior vice president with New York City-based research firm Real Capital Analytics (RCA). “These assets are in dense urban areas and the competition from other property uses like offices and residential drives up the land value component of these assets.”

Data on the value of Macy’s total real estate portfolio, and its urban properties in particular, is scant. That hasn’t stopped interested parties from trying to put a price on Macy’s real estate. Starboard Value, a New York City-based investment advisor, believes that the retailer is holding onto about $21 billion in real estate, based on a value of about $166 per sq. ft., and is urging Macy’s to consider spinning off its properties in two real estate joint ventures, according to a Morningstar research note citing a letter from Starboard to Macy’s.

Macy’s has not made its intentions public, but two recent executive additions to its management team and board of directors, both with strong REIT and financial advisory backgrounds, indicate that it might at least be warming up to some of Starboard’s ideas.

In March 2016, William Lenehan, president and CEO of Four Corners Property Trust, joined Macy’s board of directors. Four Corners Property Trust is the Orlando, Fla.-based REIT that was spun off from the 424 restaurants and real estate assets of Darden Restaurants, Inc. in November 2015. The deal, valued at around $417 million, works like a 15-year triple-net-lease transaction, in which Darden Restaurants manages and leases 418 of the properties back from the newly established REIT, according to documents detailing the spinoff.

In April, Macy’s announced that it had appointed Douglas Sesler as its executive vice president for real estate. Sesler’s background is steeped in real estate investment banking, most recently as president of True Square Capital, a New York City-based real estate advisory firm. He was also co-head of the global real estate investment banking group at Merrill Lynch.

Only time will tell if having the CEO of a spinoff REIT on its board and a real estate investment advisor will be enough to persuade Macy’s to devise a decisive strategy for unlocking the monetary value of the 400 stores that it owns. The first question is: What values does Macy’s place on its crown jewel properties?

“How, for instance, can one value the space they have at Herald Square? There really are no sales comparables,” Costello said.

Not officially, at least. But the Herald Square store, for example, already produces about $454.54 in sales per sq. ft., based on published estimates of $1 billion in annual sales. Perhaps the chain’s other urban locations are not to far behind.

Monetizing its properties will confer short-term benefits on Macy’s, according to Morningstar. But if the retailer wants to regain its health, it will have to pare down square footage to stay in step with e-commerce trends, the firm’s analysts say. Macy’s already has a model for that in its 2015 deal with Tishman Speyer to have the latter buy five of the nine floors in its downtown Brooklyn property for $170 million, and use the proceeds to renovate the remaining space.

“Rather than sell [the properties] outright, the strategy that Macy’s pursued in Downtown Brooklyn may be a better option for everybody,” Costello says.