The first quarter was a tepid period for activity in the CMBS market. Domestic, private-label CMBS deals totaled $17.8 billion, a 32 percent drop in volume compared with the $26.3 billion completed during the same period in 2015. There was also a 54 percent drop in the number of individual entities that came forward with bond transactions, according to an analysis from Commercial Real Estate Direct.

While the CMBS market lumbered along, it did so without Simon Property Group. The largest retail REIT in the country decided to issue $1.3 billion in senior unsecured notes to investors in January. The proceeds will pay down three existing mortgage loans, repay some borrowings from its unsecured revolving credit facility and apply to other general corporate uses, according to information from Fitch Ratings.

At around the time that Simon completed the deal, the cost of CMBS market debt began to increase, thanks in part to instability in China that reverberated through to the U.S. debt markets. Now market sources are wondering if Simon, one of the most adept users of the unsecured debt markets, will return to CMBS at all this year.

“Over the next 10 years, Simon Property Group has between $1.2 billion and $4.3 billion of debt maturing per year,” Britton Costa, director of corporate ratings for U.S. REITs with Fitch, said in an email. “There will be at least $1.6 billion of debt, on average, that will need to be refinanced in either the secured or unsecured markets.”

The company has already lowered much of its cost of outstanding unsecured debt, and has plenty of access to capital. The CMBS market does not appear to be an attractive option.

Have market winds shifted?

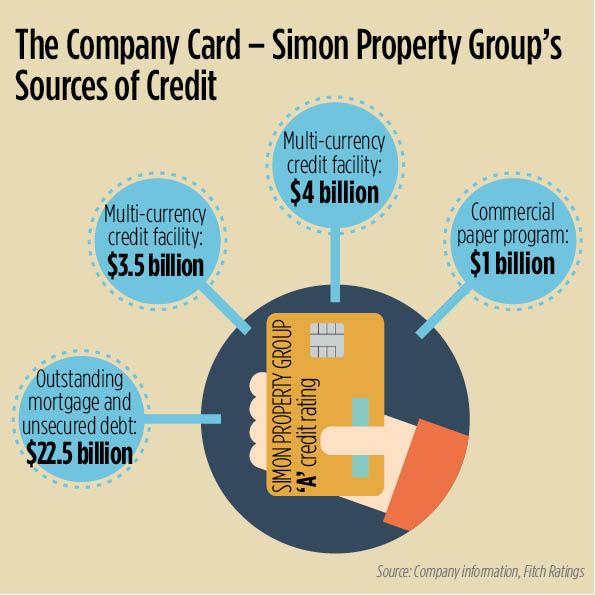

Simon’s mortgage and unsecured indebtedness stood at $22.5 billion at the end of 2015, according to the company’s 2015 year-end financial statement. Over the last two or three years interest rates have been very low for unsecured debt, says Roy Shepard, a senior analyst of equity research at Edward Jones.

“Simon can go out and issue 10-year notes, for about 3.3 percent,” he says. “If they took out a mortgage, they would probably pay more than that?”

Encumbering a trophy property, or any other part of its portfolio, with new mortgage financing seems unnecessary, judging by the savings Simon is able to realize by other means of financing. Senior notes that were issued to investors had a weighted average term of 8.2 years and a weighted average coupon rate of 2.97 percent. Part of the proceeds would redeem notes with a 2016 maturity that carried an interest rate of 6.1 percent.

The markets are only into the second quarter this year and another advantageous deal could await Simon later in 2016. But so far, pricing in the CMBS market has fluctuated and, more recently, it has been showing signs of widening, not tightening. Last week, yields on triple-A rated CMBS notes slackened between one and four basis points, while triple-B-rated bonds widened between eight and 16 basis points, according to Trepp Talk, which offers debt markets data and commentary.

“Compared to a year ago, CMBS debt is still a bit pricey,” one capital markets investor said.

Shoring up the ‘fortress balance sheet’

Simon oversees what Morningstar refers to as a “fortress balance sheet.” Aside from replacing existing senior debt with lower-cost funding, the company has what Fitch analysts refer to as the most consistent and durable access to capital in the REIT sector.

The bricks in that fortress include a $1 billion commercial paper program, which typically involves short-term debt with 30 to 90-day maturities. The REIT also has two multi-currency credit facilities totaling $6.75 billion. That gives Simon the largest credit capacity in the U.S. REIT sector, according to Fitch Ratings.

Simon recently expanded its $2.75 billion unsecured, multi-currency supplemental credit facility by $750 million, according to the company. The terms of the facility were also amended to allow Simon to increase it even further, to $4.25 billion, so it has even more flexibility and access to future credit.

With a fortress that seems to be getting stronger, not worn down, it looks like Simon has many other funding options for the future outside of securitization.

“It is really not part of their funding strategy at all, especially for a larger REIT like Simon, which has an ‘A’ credit rating,” said Roy Shepard. “They don’t need to do [a CMBS transaction.] They could just issue unsecured notes.”