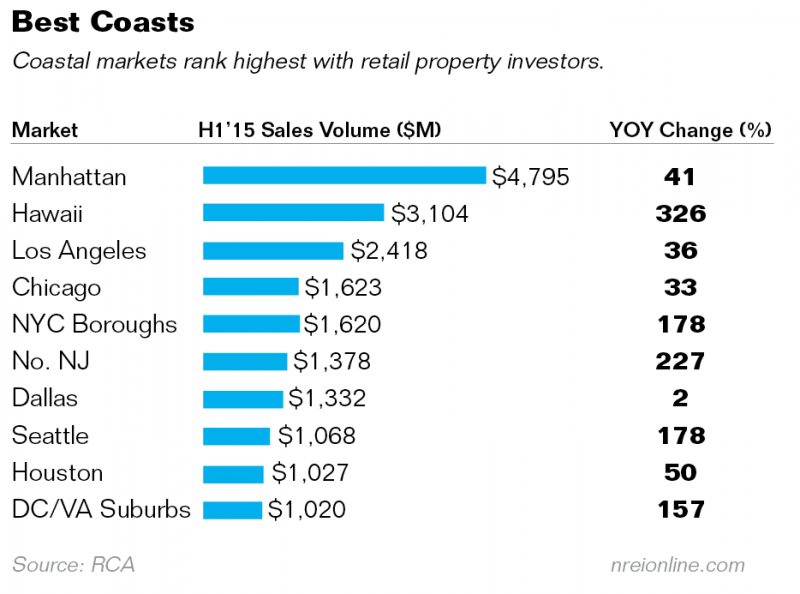

Coastal markets continued to attract the most retail property investors during the first half of this year, according to recent data from Real Capital Analytics (RCA). Seven of the 10 most active investment sales markets were coastal, with Chicago, Dallas and Houston the exceptions.

The top 10 markets, led by Manhattan, accounted for roughly 42 percent of the total investment sales volume during 1H15, according to RCA, and all but one saw double- or triple-digit growth in sales volume. Of the top 10 markets, Hawaii had year-over-year growth of 336 percent, which was an aberration.

“During the first half of the year, investors actively acquired urban storefront retail,” says Jim Costello, senior vice president at RCA.

In Manhattan, for example, Vornado Realty Trust paid $355 million for the Old Navy flagship store. That price equates to $4,565 per sq. ft. And in Chicago, Ponte Gadea dropped $176 million for 58-104 East Oak Street.

A balanced market

Nationwide, the retail sector recorded $45.6 billion in sales during the first half of the year, an increase of 11.8 percent from the same period last year. Unlike other property sectors, more retail properties traded during the second quarter than the first quarter, with deal volume increasing 22 percent year-over-year to $19.1 billion.

From January thru June, individual asset sales accounted for majority of investment transactions. Volume was up 17 percent year-over-year to $28.5 billion. Meanwhile, portfolio transaction volume declined to $12.4 billion, primarily because of the Cole Capital buyout that occurred in 2014.

“Supply is catching up with demand, and this is a more balanced market today than we have seen in the past few years,” says Daniel Finkle, senior managing director of HFF. “That being said, there continues to be a lack of ‘trophy’ retail centers and compelling value-add deals in infill locations being offered.”

During the first half of the year, Manhattan experienced the largest sales volume, with $4.8 billion worth of retail properties changing hands. That figure is up 41 percent from the same time a year earlier, according to RCA.

Hawaii ranked second in investment sales volume behind Manhattan. Over the past six years, the state has ranked 33 out of the top 40 markets, but this year it saw $3.1 billion in total retail sales. The leap can be attributed exclusively to transactions related to Ala Moana Center.

AustralianSuper, one of Australia’s largest pension funds, purchased a 25 percent stake in Ala Moana Center from General Growth Properties. The fund paid $906 million for a piece of Honolulu’s premier shopping center.

Los Angeles, which has ranked either first or second in the nation for the past six years for retail investment sales, dropped to third place behind Hawaii. It recorded $2.4 billion in retail property transactions, an increase of 36 percent over last year, and will likely regain its dominant position as the year goes on.

One of the largest transactions in Los Angeles was the sale of Midtown Crossing for $186.6 million. Bentall Kennedy bought the 315,683-sq.-ft. infill shopping center, which is anchored by Lowe’s, Ross and PetSmart.

Increased valuations

Prices for retail properties in six largest metro areas are now 4.1 percent ahead of the levels seen before the global financial crisis, according to RCA.

Nationally, the Moody’s/RCA CPPI shows that the prices for retail properties are 62 percent ahead of the low points following the global financial crisis. Despite these recent gains, the Moody’s/RCA CPPI indicates that retail assets are still coming in at prices 7.5 percent below the peak levels seen before the crisis.

During the first half of the year, retail cap rates continued to fall, down 30 basis points year-over-year to hit an average of 6.6 percent nationally. “Within many of these markets, limited retail development and continued improvement in retail fundamentals are driving strong leasing spreads and low vacancy levels,” Finkle notes. “This combination is driving aggressive underwriting assumptions and valuations.”