The commercial real estate business will need low interest rates, eager lenders and strong property values over the next few years to handle all the loans that are about to come due. So far, prices keep rising and lenders keep lending. What could go wrong? Experts now worry the money might be too easy to obtain. If lenders make too many risky loans, they might pump a bubble in the property markets when the capital markets need continued stability for the next three years.

Moody’s warns on underwriting

That’s particularly true for conduit loans. The experts at Moody’s Investors Service track the size of CMBS loans compared to the income produced at the properties. The average CMBS loan was 112.2 percent of the value implied by that income in the third quarter, according to Moody’s. That’s up from 108.3 percent in the second quarter.

“Transactions in our Q4 transaction pipeline signal that credit quality is likely to slip further, to an average Moody’s loan-to-value in excess of 113 percent,” according to Moody’s. “At the rate that conduit loan leverage is increasing, Moody’s loan-to-value will exceed its pre-crisis peak of 118 percent well before its 10th anniversary in Q3 2017.”

However, not all the underwriting news is bad. Bond rating agencies are also demanding that fewer CMBS bonds get the highest AAA rating. Credit enhancement levels for AAA-rated CMBS bonds are nearly double those in 2006 and 2007, which means they are more protected from potential losses, according to Fitch Rating, Inc. “CMBS originators on the whole are using more sensible assumptions… a positive development compared to what took place between 2006 and 2008,” said Huxley Somerville, managing director for Fitch.

Watching the delinquency rate

CMBS borrowers largely continue to pay their loans on time—especially compared to earlier in the recovery. That’s because property fundamentals continue to strengthen as the overall economy catches up to the recovery in commercial real estate.

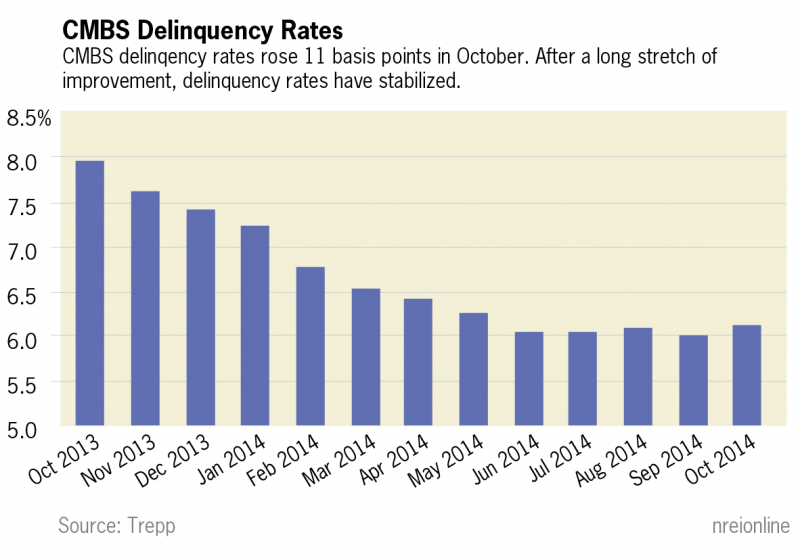

The delinquency rate for CMBS loans was 6.14 percent in October, according to Trepp. Those delinquent loans include all the loans that are more than 30 days late, including loans in foreclosure and bank-owned properties. That’s down 129 basis points from 7.43 percent at the end of December 2013 and down 184 basis points from 12 months ago.

The delinquency rate has wavered just above 6 percent for the last five months. Still, experts are jittery. When the October rate came in at 6.14 percent, many worried because the rate was up 11 basis points from 6.03 percent in September. Experts will keep watching the default rate, particularly if any surprises damage the recovery in the larger economy (for example, a possible battle over the debt ceiling in Washington, D.C., or the specter of deflation in Europe).

Over the last year, CMBS delinquency rates for most property types have improved substantially, though most gave up some of that improvement in October. The multifamily delinquency rate had the worst month, increasing 81 basis points to 9.80 percent in October. A year ago that rate was 11.02 percent. Multifamily loans remain the worst performing among the major property types. Lodging loans have performed the best, with a delinquency rate of 5.35 percent. Retail loans have proven the most stable, moving to 5.88 percent in October from 6.34 percent the year before.

Maturing CMBS loans

The credit markets need to keep improving so that they handle some of the last, leftover wreckage from the financial crisis—hundreds of billions of dollars in CMBS loans made during the previous boom that will hit their 10-year terms in 2015, 2016 and 2017. Over the next three years, more than $300 billion in CMBS loan balances will mature. That’s more than 2.5 times the amount that matured from 2012 to 2014, according to Trepp.

Right now, capital markets and property prices seem to be healing just in time for borrowers to refinance these loans, provided nothing terrible happens over the next few years.

At current rates and prices, most (but not all) of these loans would be able to simply refinance. Assuming lenders require at least a 1.50x debt service coverage ratio on new loans, 82 percent of loans maturing between 2015 and 2017 would be eligible to refinance at current debt and income levels, according to an analysis by Trepp. That leaves 18 percent of these expiring loans potentially in trouble.

Underwriting is tougher now on the latest generation of CMBS loans, but the difference is not enough to create an impossible challenge for most loans needing to refinance. The average loan-to-value ratio was 59.09 percent for CMBS loans made in 2014, according to Trepp, compared to 65.36 percent for loans coming due in 2017. Office and retail loans make up 63 percent of the loan balance maturing in the next three years, with multifamily loans at 14 percent.

Experts continue to hope for no surprises as these loans come due. “All of this will have to happen in an environment of uncertainty in terms of interest rates, property values, and a shifting landscape in office and retail property usage,” according to Trepp.