It’s another wacky week on the Mills Corp. roller coaster. First, another vertiginous dip as the company disclosed more problems with its massive Xanadu project in New Jersey’s Meadowlands. Then things turned up—briefly--as the cash-strapped developer announced a deal to raise $500 million by selling three international assets. But then investors took another scary plunge when the company revealed the departure of several top executives. Today alone Mills shares have dropped 17 percent, hitting a new 52-week low of $13.41. Overall, Mills’ shares are now down 78 percent from last September, when Mills first revealed accounting troubles and an SEC investigation.

In an SEC filing late yesterday, Mills disclosed that “effective Aug. 11, Mark Ettenger’s services as president have been terminated.” Ettenger, president since Jan. 2004, is still employed, though Mills did not say in what capacity. The company also said James A. Napoli, vice president of leasing, notified the company on July 31 that he is resigning and will leave on Oct. 27. That leaves an executive team of Laurence Siegel as chairman and CEO; Mark Ordan, who joined the company in March, as COO; Richard Nadeu as CFO; F. Scott Ball as executive vice president, asset management and D. Gregory Neeb, executive vice president and chief investment officer.

Analysts were troubled by both departures, citing Ettenger’s track record in selling malls. As managing director at Goldman, Sachs & Co. overseeing its Real Estate Asset Sale business, Ettenger was instrumental in the sale of Cadillac Fairveiw's U.S. real estate assets, Jacobs' regional mall portfolio, IBM's regional mall portfolio and Ala Moana; the acquisition of Hahn's regional mall portfolio and Centermark's regional mall portfolio. Given Mills’ need to sell assets, Ettenger’s loss is a major blow. Moreover, the departure of its top leasing executive in Napoli is troubling given that the massive Meadowlands Xanadu project still needs to line up tenants in order to get the project built.

The announced changes at the top came just one day after Mills had announced some good news in that it intends to sell the Vaughan Mills in Ontario, the St. Enoch Centre in Glasgow, Scotland and Madrid Xanadu in Spain to its Canadian development partner Ivanhoe Cambridge for a combined $981 million. Overall, the deal will result in $500 million in net proceeds after Mills pays its proportionate share of costs associated with the projects and the transfer of assets. Ivanhoe already owned a 50 percent stake in Vaughan Mills and St. Enoch Centre, but wasn’t previously involved with the Madrid Xanadu project, which is wholly owned by Mills.

The announced changes at the top came just one day after Mills had announced some good news in that it intends to sell the Vaughan Mills in Ontario, the St. Enoch Centre in Glasgow, Scotland and Madrid Xanadu in Spain to its Canadian development partner Ivanhoe Cambridge for a combined $981 million. Overall, the deal will result in $500 million in net proceeds after Mills pays its proportionate share of costs associated with the projects and the transfer of assets. Ivanhoe already owned a 50 percent stake in Vaughan Mills and St. Enoch Centre, but wasn’t previously involved with the Madrid Xanadu project, which is wholly owned by Mills.

The $981 million price tag values the properties at an impressive $407 per square foot--$84 higher than analysts’ estimates. Mills plans to use that to pay down part of the $2.23 billion loan it got from Goldman Sachs Mortgage Co. earlier this year. Banc of America Securities analyst Ross Nussbaum believes that the deal has increased Mills’ NAV estimate by about $1.

Even so, analysts were not placated. “Asset sales [are] a step in the right direction, but we believe that Mills will need to raise another $600 to $700 million of excess proceeds, either through additional asset sales or an equity infusion to satisfy the repayment and ‘adequate liquidity’ requirements of the Goldman term loan,” Nussbaum wrote.

And the proposed transaction is only a mild salve, coming on the heels of Mills SEC filing last Friday divulging some details of the accounting missteps that have gotten the REIT into hot water. The company said it would reduce the stated value of its assets by as much as $315 million.

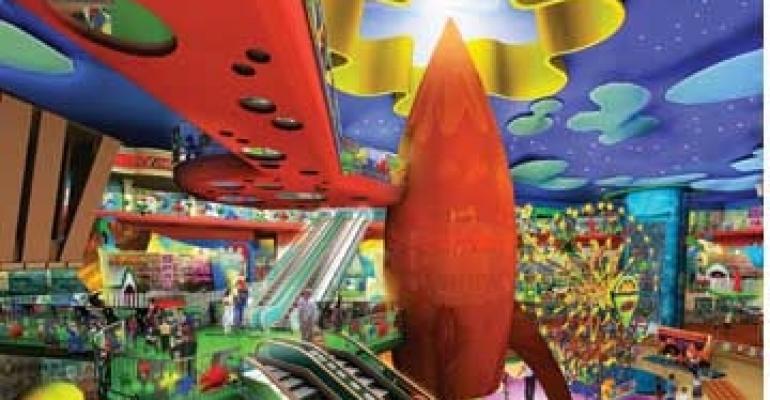

Probably the worst news of the week was the fresh details about the troubled Xanadu project, which Mills says will cost $2 billion, about $800 million more than the company had said previously. The 4.8 million-square-foot Meadowlands project has been an obstacle for potential buyers of Mills.

In May, the company put itself up for auction but the deadline came and went in June with no buyer emerging. To make itself more attractive to potential buyers, Mills has been looking for a joint venture partner to take the property off its hands.The Xanadu news—few tenants, but plenty of cost over-runs—is not likely to bring forth a partner, at least on acceptable terms.

“The Meadowlands Xanadu is more of a dead weight than anything else – it has potential, but there’s no one who wants to take on that much risk and it would be better for Mills if somehow they could get rid of it,” Moore says.

Backing away isn’t an option given that Mills has already sunk $380 million into the project including $160 million for a 75-year ground lease for the site in and more than $70 million on site work. In addition, it does have commitments from key tenants totaling 300,000 square feet of space, including Cabela’s, but it needs more retailers signed on before it can line up the construction financing it needs to make the project a reality.

That alone could be why a number of retail REITs, including Simon Property Group, Inc. and Taubman Centers, Inc., as well as some of Mills largest institutional investors have expressed some interest in buying Mills, but ultimately have not closed a deal, wary of buying a potential Trojan horse.

Spurring buyer interest, however, could have been a motivating factor behind the Ivanhoe Cambridge deal, according to some analysts. It improves Mills financial standing, but more importantly, it shows potential buyers that the longer they wait, the more likely they are to lose some of the best properties in Mills’ portfolio.

“Someone like Simon might have been interested in Madrid Xanadu, but they can’t get it now,” says Richard Moore, a REIT analyst with RBC Capital Markets. “And if Mills does more of these [dispositions], the bidders would lose the opportunity to get other properties, so it’s a pretty good thing for Mills. It’s going to motivate some of the potential buyers to maybe put in more bids.”

Moore mentions the Shops at Riverside, a 600,000-square-foot mall in Hackensack, N.J., the 800,000-square-foot Falls in Miami and the 2.2 million-square-foot Sawgrass Mills in Sunrise, Fla. as some of the company’s most attractive holdings.

The sale also effectively gets rid of Mills’ international division, without which the company might be easier to operate. Mills is now left with only one foreign project in the pipeline – the 800,000-square-foot Mercati Generali shopping center in Rome, Italy, which had been scheduled for completion in 2008. For now, it is unclear whether the development will go forward.

“Without any exposure to international locations, Mills’ portfolio probably seems much more desirable for a buyer seeking a United States-based mall portfolio, or for an acquirer looking to add to its current mall holdings,” writes Morningstar analyst Ryan Dobratz.