Tracking data ultimately improves any system, and nowhere has that been proven more than in the green building industry. Programs like LEED are encouraging owners, developers, tenant users and even investors that sustainability is not just achievable, it’s also cost-effective.

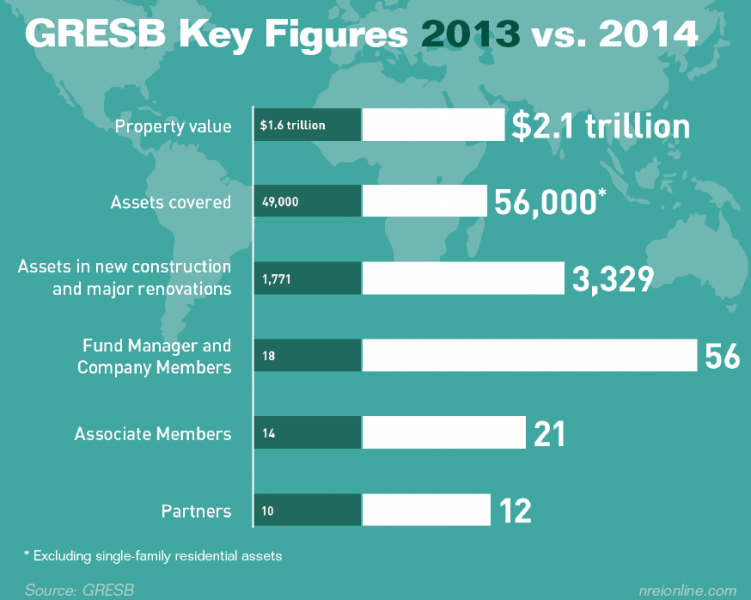

Investors have been the latest to attribute value to green data measurements, with the Global Real Estate Sustainable Benchmark annual survey having launched in 2009. However, since that time, participants in the survey have grown from 198 companies to 637 listed property firms and private equity real estate funds, covering about 56,000 commercial properties.

Most importantly, the amount of sustainability data collection at many large global property firms has quadrupled. Five years ago, less than one in five of the companies in the first survey had some information on energy consumption. Today, according to the recently released 2014 GRESB survey, almost 80 percent of the participant firms measure energy use. The survey participants also reported that both carbon emissions and water consumption are down at the firms.

Elsbeth Quispel, head of sustainability for GRESB, says today’s investor is now insisting that funds and companies track green data. “They want to be able to compare themselves to their peers, they don’t want to lag behind,” she says. “Thus, the survey participants are taking more effort to how what they’re doing, and they’re really getting into the details. Showing improvement on sustainability has become very important in the business world.”

The GRESB group, based in Amsterdam, opens the survey for participants each April for three months. Investors who monitor the results include Arcadis, Cohen & Steers, Aviva, TRS and Kames Capital. Participants include Bentall Kennedy, Prologis, Brookfield, CBRE, Regency Centers and Vornado Realty Trust. Each participant fills out the 48-page survey, with questions in eight categories: management, policy and disclosure; risks and opportunities; monitoring and EMS; performance indicators; building certifications and stakeholder engagement. Each summer, GRESB validates the data for a random sample of participants by requesting evidence for the answers, and eight participants are singled out for site visits for an in-depth assessment.

Quispel says the overall score has increased by nine points, and is now at 47 out of 100, based on answers in the eight categories. The scores are ranked in a four-category scale, from “Green Starters” (beginners) to “Green Talk” to “Green Walk” to “Green Stars” (sustainability experts). The average score is still somewhere in the “Green Walk” Range. Many firms that are veterans with the survey have increased their scores, she says, but new companies are being added every year that are starting at the bottom.

Not only has participation increased, but companies now believe in green operations. About 72 percent of the firms now publicly report sustainability objectives and goals, compared to 44 percent in 2013, according to the recent survey. About 84 percent now disclose their green performance, compared to 61 percent in 2013. Three out of four firms now have a data management system in place for energy and water consumption at almost every building. More than half of the firms now use tenant satisfaction surveys for sustainable issues, and 65 percent of the companies say they insist on green products in their procurement processes.

Gail Haynes, president of the Pension Real Estate Association, believes sustainability should be at the forefront of business planning and analysis for all companies, particularly the institutional community. “The built environment accounts for a large proportion of carbon emissions and other environmental impacts, and our industry is poised to contribute significantly to global sustainability improvements,” she said in a statement.

The GRESB survey also breaks down by region, with North America firm scores lagging behind those of Europe and Asia. Australia and New Zealand, however, outshine all the regions, scoring very well on the heavily-weighted Performance category, such as specific reporting on energy and water consumption, waste and emissions. North America ranked highest in the risk management and building certification categories.

Many countries are implementing environmental regulations that are pushing the firms to the increased reporting, Quispel says. By 2020, for example, all new construction in European Union countries will need to reach a “nearly zero-energy” standard. More U.S. cities are enacting green building requirements. Quispel says that’s a positive step on the part of participant firms, and their investors, to get a jump on what will look like an entirely new sustainable decade in six years. “It really makes sense to get ready for this now,” she says. “Not only do we face the risk of climate change and its implications, it’s also become important for any sort of business to pay attention to.”