NEW YORK—Pembrook Capital Management LLC has closed $27 million of new financing for three apartment properties in New York City. Comprised of two mezzanine loans and a bridge loan, Pembrook’s financing facilitated three different projects with total capitalization of approximately $135 million.

“The real estate financing market continues to evolve in the wake of the last downturn,” said Stuart J. Boesky, Pembrook’s president and CEO. “Debt financing in particular has become more challenging for sponsors, even those pursuing well-located projects in the strongest markets. Given that imbalance, we see the opportunity to help get deals done by providing an array of financing alternatives.”

These properties include:

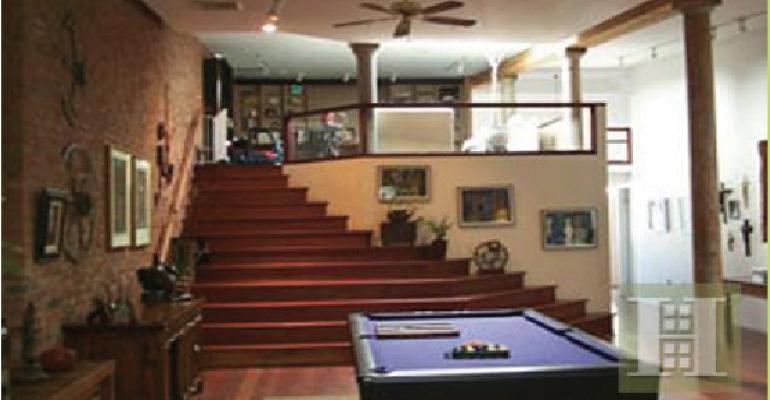

• 148 Duane Street, which received a $15.5 million bridge loan for the acquisition, renovation and repositioning of a 15,900-sq.-ft., five-story apartment building with ground-floor retail located in the Tribeca neighborhood.

• 62-74 Avenue B, which received a $3.5 million mezzanine loan for a residential conversion project. The sponsor is redeveloping the property as an 81-unit property in the East Village.

• A multifamily portfolio on Pelham Parkway in the Bronx, which received an $8 million mezzanine loan for the acquisition of a portfolio of five elevator apartment buildings.