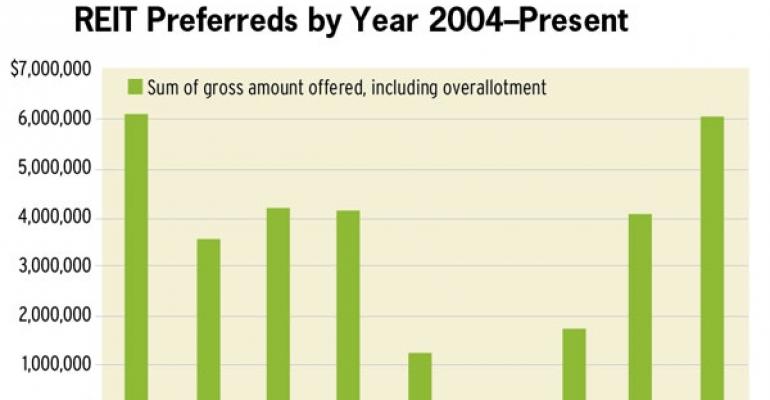

REITs are taking advantage of the voracious investor demand for preferred stock, issuing nearly $6 billion in preferred stock so far this year.

In fact, 2012 already ranks as the second most active year for preferred stock issuance since 2004 when REITs issued $6.1 billion, according to SNL Financial. With five months still left in the year, it’s likely that 2012 will take over the number one spot; experts forecast that issuance activity will continue to be strong as yield-hungry investors continue to look beyond bonds.

“There’s been a huge uptick in the amount of preferred stock issued over the past 12 to 18 months, and a marked increase during the past six months,” says Matt Werner, a portfolio manager and analyst for Houston-based Chilton Capital Management LLC. “Demand is so strong that REITs have been able to issue stock at all time lows. They realize they may never be able to issue preferreds this cheap again, and those that continue to worry about the capital markets are making their move now.”

Earlier this month, for example, Vornado Realty Trust announced that it plans to raise $300 million from a public offering of perpetual 5.7 percent Series K cumulative redeemable preferred shares. And last month, Public Storage issued $287.5 million in preferred stock prices at 5.6 percent. (It’s interesting to note that the self-storage REIT finances its business solely with preferred and common equity.)

Yield rates for this year’s issuances range from 5.6 to 6.5 percent, according to SNL Financial.

Historically, preferred stocks have offered yields that range from 6.3 percent to 9 percent with an average yield spread over 10-year Treasuries of 480 basis points. The yields on recent issuances have compressed the yield spread, but it’s still more appealing than today’s low yielding bond instruments.

For REITs that issue preferred stock, it makes up about 10 percent of the capital structure today, according to experts. Prior to 1997, there was a limited amount of REITs that issued preferred stock; today there are more than 50 REITs that do so.

Werner says the decision to issue preferred stock today is similar to a borrower locking in low interest rates on debt.

“Preferred stock is an alternative to traditional debt, and the decision to issue this type of equity really comes down what REIT CFOs want their capital structures to look like,” he notes, adding that many REIT executives view preferred stock as form of permanent debt for their companies. “Operationally, they never have to worry about it maturing, so there’s no refi risk for them.”

Less risky than common stock

Many investors view preferred stock as an alternative to bonds; preferred stock is a low-risk investment that offers a higher yield than bonds.

“Investors aren’t getting yield in other parts of the market, so they’re increasingly attracted to preferred stock,” Werner says. “They’re willing to accept a lack of future price appreciation for the guaranteed yield that preferred stock offers.”

Not only do REIT preferred dividend yields generally exceed the dividend yield on the common stock, they are fixed and do not fluctuate with a REIT’s earnings. However, this can be a double-edged sword if a REIT’s taxable income increases and it decides to increase its common dividend payments since preferred stock investors are unable to share in the upside.

Importantly, dividends for preferred stock are perpetual—they also accumulate and accrue over time. If a REIT cuts or suspends its dividend, they continue to accrue for preferred shares, and the REIT will have to make good on the unpaid dividends.

Moreover, preferred stockholders receive their dividend before common stock investors receive any payment. In practical terms, this means that if a REIT finds it challenging to continue to pay interest on its bonds and dividends for its shareholders, the amount of money that is available to meet financial obligations is paid first to bondholders, then preferred stockholders and finally common stockholders.

Preferred stock investors are exposed to some reinvestment risk since REITs can redeem preferred stock. Most REIT preferred stocks are callable in whole or in part by the issuer five years after issue and anytime thereafter.

Many investors have implemented a blended strategy—buying both REIT common stock and preferred stock. This strategy allows investors to take advantage of any dividend growth and stock appreciation from common stock, while enjoying higher dividend yields from preferred stock.

Werner says his firm has advised many clients to adopt this blended strategy. “Typically we breakdown to 60 percent common and 40 percent preferred, which averages to a 5 percent yield,” he explains, adding that it’s very common to own common and preferred stock from the same issuer, but there are some situations where a REIT’s preferred stock is far more appealing than common stock.