After a dismal performance in 2007 that ran into this year, REIT stocks are once again on the ascent, posting a three-month rally. As of early June, the REIT sector had outperformed the broader market year-to-date — as it did during the seven-year REIT bull run that lasted from 2001 to 2007. For shopping center and regional mall REITs the story was even better.

As of June 6, the MSCI REIT Index produced a total return of 5.77 percent, year-to-date, while the SNL US REIT Equity Index had a total return of 5.45 percent. By comparison, the S&P 500 Index declined 6.46 percent and the Russell 3000 Index fell 5.38 percent.

What was behind this robust run? Industry experts attribute the stock “bounce” to the fact that devastating economic news has been kept to a minimum during the past few months, giving investors courage. Moreover, investors seem to have realized the distinction between commercial and residential real estate. Also, they are not lumping REITs in with financial services firms, which are taking a hit.

“So far this year, REITs are distinguishing themselves as one of the top performers in the stock market — they're showing their defensive stripes compared to the rest of the market,” says Paul Adornato, a REIT analyst with New York City-based BMO Capital Markets. “This REIT rally means that REITs are priced almost to perfection.”

Retail REITs, including shopping center, regional mall, outlet center and retail net lease REITs, are outperforming the broader REIT industry. As of June 6, the SNL U.S. Retail Index posted returns of 4.45 percent — the third highest in the industry. (Self-storage REITs and multifamily REITs are the only sectors that have outperformed retail REITs at 17.59 percent and 14.41 percent, respectively.) As a result, retail REITs sit just 3.4 percent below their peaks in early 2007.

Strong first-quarter results across the retail REIT sector supports the market's pricing. Most retail REITs are meeting or beating analyst expectations and posting healthy FFO gains. Still, there is some trepidation in the market, especially with widespread concern that commercial property values may continue to free fall.

Outperforming the market

Ten years ago, REIT stocks did not yield impressive returns. Then all the big money was being made in technology stocks. When the dot-com bubble burst, investors quickly moved into REITs.

From March 2000 to December 2006, REIT stocks enjoyed a bull market, says Ralph Block, a long-time REIT investor and publisher of the Essential REIT. For example, the five-year compounded return for the MSCI REIT Index was 17.29 percent compared to the S&P 500 Index's 8.26 percent and NASDAQ's 9.98 percent, according to NAREIT.

It came to a screeching halt in 2007. After starting the year on a high note, things quickly tanked as the subprime mortgage crisis hit and the credit crunch took hold. As a result, last year REIT total returns plummeted 16.82 percent. By contrast, the S&P 500 Index was up 5.49 percent, according to Charlottesville, Va.-based SNL Financial.

And, for the 12 months between May 2007 to May 2008, U.S. REIT total returns were down 13.97 percent; but that performance was in line with other major indices. For example, the S&P 500 Index total return for the same period was down 8.22 percent S&P, according to NAREIT.

However, in March and April the market started to shift. Wall Street telegraphed that in six to eight months REITs would produce decent first- and second-quarter results. The first quarter's good news was already reflected in the stock prices, analysts note. Within the retail REIT sector, 15 of 29 REITs had positive total returns as of June 6. In 2007, 24 of 29 retail REITs had negative returns. Despite the expectation that necessity retail would hold up better in a recession, regional mall REITs have produced better returns than shopping centers, according to SNL Financial. As of May 7, the SNL US Retail REIT Enclosed Mall Index posted a total return of 9.98 percent, while its corresponding Shopping Center Index recorded a total return of 8.8 percent.

Among regional malls, Simon Property Group generated the highest total return, according to SNL Financial, with Taubman Centers and CBL & Associates Properties following at 9.64 percent and 9.50 percent, respectively. Within the shopping center sector, Cedar Shopping Centers and Urstadt Biddle Properties, with a total return of 12.88 percent, posted the best total returns, while Kite Realty Group, at -8.12 percent, provided the worst.

Debating NAV

While REIT stock prices hit their most recent lows in January and February, analysts says REITs are still a bargain for investors — just not quite as much. “If you look at REITs as a discount to NAV or multiples to FFO, they've bounced off the bottom and they're more fairly valued now,” says Rich Moore, managing director of Cleveland-based RBC Capital Markets.

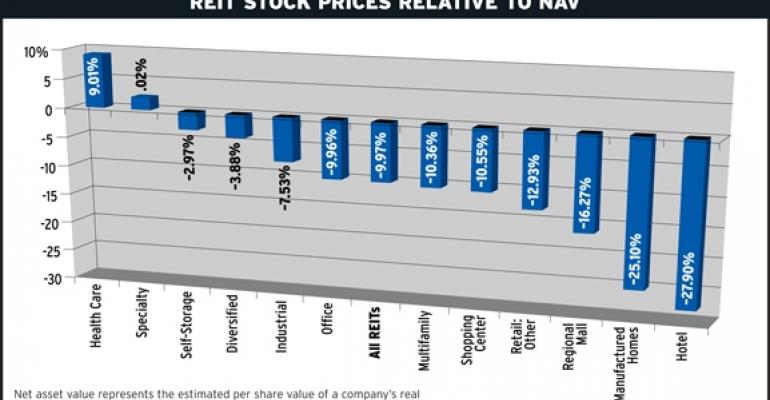

Jason Lail, an analyst with SNL Financial, says the entire REIT sector is trading at a discount to NAV. As of June 6, the industrywide discount was 9.97 percent. Of all the REIT categories, only health care REITs and specialty REITS were trading at premiums: 9.01 percent and 0.02 percent, respectively.

“Retail REIT stocks are not trading at the premiums they have been in the past, and some would consider them to be at a discount,” says Dionisio Meneses, co-portfolio manager of the Schwab Global Real Estate Fund, which has about 25 percent of its total capital invested in retail REITs, including Westfield Property Trust and Simon.

Meneses contends that REITs should trade at premiums to their NAV over the long term. “The theory is that REITs have professionally managed assets and investors are paying the team to continue to maintain and garner value out of the existing portfolio,” he says.

Since most investors consider shopping center REITs to be a more defensive investment because they are associated with necessary retail rather than discretionary retail, they were trading at a 10.5 percent discount to NAV, according to Lail. Regional mall REITs, however, were being priced at a 16.27 percent discount to NAV.

Concerns about falling real estate values have called REIT NAVs into question. Several investors say that the NAVs that analysts are using today are inflated and need to be adjusted to reflect softer cap rates.

Worcester, Mass.-based Cutler Capital Management is uncomfortable with the current calculations of REIT NAVs, says Geoffrey Dancey, a securities analyst with the investment advisory firm.

Cutler Capital, which manages three hedge funds totaling $75 million and another $200 million in separate accounts for high-net-worth individuals, holds about 20 percent of its investments in real estate. Others say that REITs are in a risky position. Moore says REITs remain under pressure from the ongoing credit crisis and weak economy. “I still think there's some danger and prices could easily come down again,” he warns. “I don't think it's all over yet.”

But, Moore is quick to point out that even though REIT stock prices might see more movement, fundamentals are steady. “Investors can whipsaw stock prices all over the place, but there's not a lot of volatility in overall REIT financial performance,” he says.