Like the majority of the U.S. REIT universe, shopping center REITs outperformed analyst expectations in the first quarter of 2009, largely because of low performance guidelines. Out of 13 sector REITs, more than half beat consensus analyst estimates. Core operating metrics, however, including occupancy and income, showed some softness and will likely continue to do so for the remainder of the year, according to industry insiders.

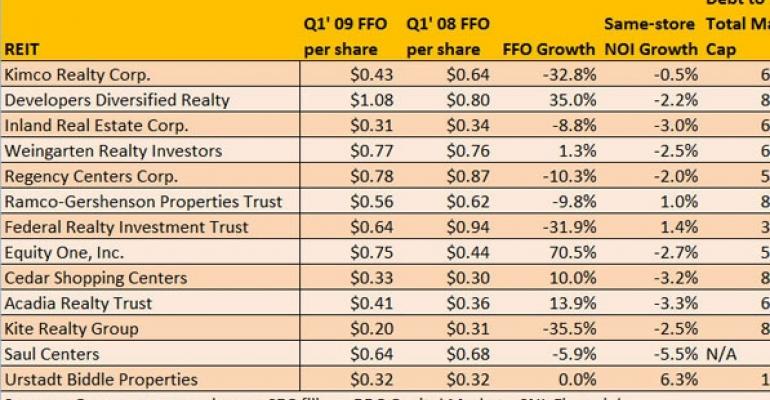

For the three months ended March 31st, seven shopping center REITs beat consensus analyst estimates, by a range of $0.01 per share to $0.33 per share. The outperformers included Cedar Shopping Centers (NYSE: CDR), Weingarten Realty Investors (NYSE: WRI), Acadia Realty Trust (NYSE: AKR), Regency Centers Corp. (NYSE: REG), Developers Diversified Realty (NYSE: DDR), Ramco-Gershenson Properties Trust (NYSE: RPT) and Urstadt Biddle Properties (NYSE: UBA and NYSE: UBP). Two firms, Federal Realty Investment Trust (NYSE: FRT) and Saul Centers Inc. (NYSE: BFS), reported results that were in-line with analyst expectations. Four REITs, including Kimco Realty Corp. (NYSE: KIM), Inland Real Estate Corp. (NYSE: IRC), Equity One, Inc. (NYSE: EQY) and Kite Realty Group (NYSE: KRG), missed consensus estimates. The misses were small, ranging from $0.01 per share to $0.02 per share.

"Shopping center REITs are mostly ahead of consensus estimates, but from an operational metric standpoint, the [performance] was soft. Better than we expected, but still soft," says Rich Moore, an analyst with RBC Capital Markets.

Same-store NOI growth in the first quarter was almost universally negative and occupancy levels continued to decline. What's more, access to cash remained limited, forcing several REITs, including Inland, Regency and Weingarten Realty Investors, to reduce dividends or suspend payments altogether in bids to build up cash reserves. Developers Diversified Realty, the largest shopping center landlord in the country with 155 million square feet of space, already announced that it would pay its 2009 dividend with a combination of cash and stock.

Cedar Shopping Centers, a Port Washington, N.Y.-based REIT with a 12.7-million-square-foot portfolio, posted one of the best performances in the sector, beating consensus analyst estimates by $0.33 per share. The firm reported FFO per share of $0.33, representing a 10.0 percent increase from $0.30 per share reported in the first quarter of 2008. Cedar's CEO Leo Ullman credited the REIT's solid performance to its reliance on supermarket-anchored properties, the kind of asset generally considered recession-proof.

However, Cedar still experienced a 100 basis point drop in portfolio occupancy year-over-year, to 95.0 percent from 96.0 percent in March 2008. The company's same-store NOI decreased 3.2 percent.

Meanwhile, Beachwood, Ohio-based Developers Diversified beat consensus estimates by $0.02 per share. The firm posted FFO per share of $1.08—35.0 percent above the $0.80 per share reported in 2008. The company continued to address its leverage issues throughout the first quarter (its debt to total market cap ratio is one of the highest in the sector, at 87.36 percent) with share sell-offs and asset sales.

However, occupancy at Developers Diversified's portfolio dropped 530 basis points, to 90.7 percent from 95.6 percent and its NOI went down 2.2 percent.

Kimco Realty Corp., the second largest shopping center landlord in the country with 113 million square feet of space, missed consensus estimates, by $0.01 per share. The New Hyde Park, N.Y.-based firm reported FFO per share of $0.43—down 32.8 percent from $0.64 per share reported in the first quarter of 2008. Occupancy at Kimco's portfolio declined 340 basis points, to 92.6 percent, and NOI went down 0.5 percent.

However, the firm's executives feel confident enough about the firm's performance and its balance sheet to look forward toward new property acquisitions.

"Given the enormous changes in asset values and credit markets over the past six months, it is still early for most transactions as sellers and buyers struggle to find stabilized cap rates and reliable cash flows," said David Henry, president and chief investment officer of Kimco, during the company's Apr. 30 earnings call. "We do believe, however, that developers, property owners, institutions and public companies are beginning to conclude there will be substantial consolidation in our sector."

Weingarten Realty Investors, a Houston, Texas-based REIT, was another outperformer, beating consensus estimates by $0.17 per share. Weingarten posted FFO per share of $0.77, up 1.3 percent from $0.76 per share during the same period last year. Like Cedar, however, Weingarten experienced a drop in its occupancy level to 91.7 percent, 310 basis points below the 94.8 percent reported in the first quarter of 2008. Its same-store NOI declined 2.5 percent. Weingarten operates a 55-million-square-foot portfolio.

"It's somewhat the same story as with the mall REITs," says Todd Lukasik, a REIT analyst with Morningstar. "Performance was probably a little better than we expected, but NOI is down and we expect it to be down even more before the year is finished."

Acadia Realty Trust, a White Plains, N.Y.-based REIT with a 5.5-million-square-foot portfolio, beat consensus estimates by $0.09 per share. The company reported first quarter FFO per share of $0.41, up 13.9 percent compared to $0.36 per share in 2008. Occupancy at Acadia's properties fell 100 basis points, to 92.8 percent and its same-store NOI decreased 3.3 percent.

Regency Centers Corp. also beat consensus estimates, by $0.05 per share, with FFO per share of $0.78. The figure represented a 10.3 percent decrease from $0.87 per share in the first quarter of 2008. During the company's first quarter earnings call on May 7, Regency chairman and CEO Martin Stein, Jr. said his outlook has become more optimistic as he thinks the worst of the financial crisis might be over. But the economy "still has a long, long way to go before we're able to enjoy any semblance of a meaningful recovery," he added.

Regency's occupancy level declined 160 basis points, to 93.3 percent and its NOI went down 2.0 percent. Regency, based in Jacksonville, Fla., operates a 49.6-million-square-foot portfolio.

On the other end of the spectrum, Equity One, Inc. missed consensus analyst estimates by $0.02 per share, representing the biggest miss of any retail REIT this quarter, in spite of an otherwise solid performance. The firm posted FFO per share of $0.75, 70.5 percent above the $0.44 per share reported in the first quarter of 2008. Occupancy at Equity One's properties declined 90 basis points during the period, to 91.5 percent, and same-store NOI went down 2.7 percent. The North Miami Beach, Fla.-based Equity One operates 17.8 million square feet of retail space.