People have been saying it for years: America has too many malls, and Americans are all stocked up on everything they could need or want. Sluggish first quarter earnings results across the retail sector appear to be bearing this out. Yet apparel retailer Urban Outfitters had a different outcome, posting record net sales for the period.

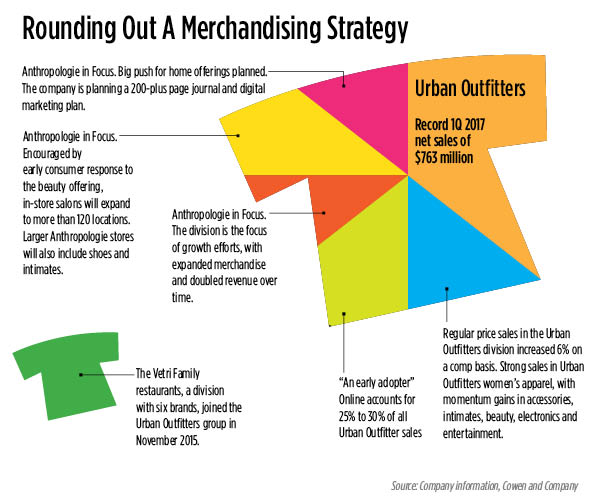

In its first quarter 2017 results, reported in May, Urban Outfitters posted record total company net sales of $763 million. The figure represents a 3.2 percent increase over the same period last year. Same-store sales for the first quarter 2017 increased too, at a rate of 1.0 percent, according to the company.

It sounds like an achievement that other retailers would envy, considering that when companies have posted sales gains lately, they have been sluggish. The company cleared a relatively easy same-sales hurdle from last year, noted one analyst, but it also appears to be capitalizing on that victory by making smart retailing decisions for the years to come, according to industry experts.

“It has also improved its merchandise significantly, which is driving better sales,” says Susan Anderson, a senior vice president and senior research analyst of specialty retail and apparel at FBR Capital Markets & Co., headquartered in Arlington, Va.

One way to win: make customers feel at home

Undeniably, foot traffic at traditional malls has declined, owing to both a sluggish economy and the rise of cross-channel, or omni-channel, retailing, which is expected to reach $1.8 trillion in the U.S. by 2017, according to research firm Forrester. Urban Outfitters stands out from other specialty retailers because it was an early adopter of the omni-channel strategy, and now derives about 25.0 percent to 30.0 percent of its total sales through e-commerce, analysts say.

The company appears to be building on a solid recent track record, too. It closed out its first quarter 2016, reported in May 2015, with increases across almost all of its main segments. Total company net sales were $739 million, a solid 8.0 percent increase year-over-year, and comparable retail segment net sales were 4.0 percent.

Declines in annual consumer spending across the industry largely stem from price deflation, since shoppers were buying the same number of items, according to a research note from Oliver Chen, a managing director at the New York-based research firm Cowen and Co.

More importantly, Urban Outfitters believes it has figured out what shoppers want, and stocked its stores accordingly. For first the quarter of 2017, the Anthropologie division achieved double-digit growth in the home, beauty and intimates category, as well as Terrain, its garden lifestyle brand, according Chen’s note. Same-store sales for the period were flat, suggesting that growth in those categories offset sluggishness in apparel categories.

The company also believes that the American retailing environment is overstored, with about ten times more square feet per capita than Europe, Chen wrote. One strategy that has worked in Urban Outfitters’ favor is that it doesn’t have a sprawling network of thousands of locations. Instead, the company decided to do something different with its locations.

Acting on the hunch that consumers have shifted their wants and needs, it decided to significantly increase the size of select Anthropologie stores, and add additional merchandise categories to the space, including Terrain or a dining option. Urban Outfitters bought the Vetri Family restaurants in November 2015, putting dining within easy reach of Anthropologie. At 20,000 to 30,000 sq. ft., the new footprints are more than two- and a half times larger than current Anthropologie stores, and the company has plans to open about four of the new, larger locations by 2017, according to Cowen.

Trying to improve the larger picture

The question is whether mall landlords and investors in the chain’s urban locations can count on Urban Outfitters to achieve long-term growth. The company sounded a note of caution, with earnings revised downward, according to the Cowen report.

Investors should continue to expect tepid results from apparel retailers, given the industry’s structural shifts, and consumers’ spending habits, Anderson said. Urban Outfitters’ results trailed the estimated 1.9 percent sales increase at clothing and accessories stores nationally, according to the Department of Commerce.

Yet Anderson also notes that Urban Outfitters’ changes, particularly in the Anthropologie brand, are positive.

“This is a good strategy to diversify its business,” she said. “Home has been much stronger than apparel; it is helping to offset weakness in apparel.”